Friday, August 30, 2019

Hurricane Dorian Heads' Up [Updated]

From our friends at Lexis-Nexis:

"Homeowners insurance: 7 things to know about what hurricane-related damage is covered"

These include special deductibles (typically found in policies issued in hurricane-prone locales) and exclusions like water damage (which is where flood insurance can come in handy)

Don't assume, and if you have any questions make sure to call your agent. We're here to help.

UPDATE:

(No nukes, either)

"Homeowners insurance: 7 things to know about what hurricane-related damage is covered"

These include special deductibles (typically found in policies issued in hurricane-prone locales) and exclusions like water damage (which is where flood insurance can come in handy)

Don't assume, and if you have any questions make sure to call your agent. We're here to help.

UPDATE:

PSA: Florida Residents Reminded Not To Open Fire on #HurricaneDorian pic.twitter.com/HenIFJSr0e— Breaking911 (@Breaking911) August 29, 2019

(No nukes, either)

Thursday, August 29, 2019

STC Redux

As in Short Term Care insurance.

La plus ca change....

Recently saw this:

The new short-term care insurance product will help purchasers pay for short-term use of home health care, adult daycare, hospice care, assisted living facility care and nursing home care, according to AARP and American Enterprise.@AARP https://t.co/Qn2gWdEvCA— ThinkAdv Life/Health (@TA_LifeHealth) August 26, 2019

To which I replied "And I'm sure it will be every bit the value that AARP's affiliate MedSupp plans are.

And BTW: This is hardly "new "

Indeed.

In fact, we blogged on them here over 7 years ago:

Hence the "Short" Term label.

Tuesday, August 27, 2019

Who'da thunk it?

From our favorite actuary:

Or more succinctly:

#ImagineThat

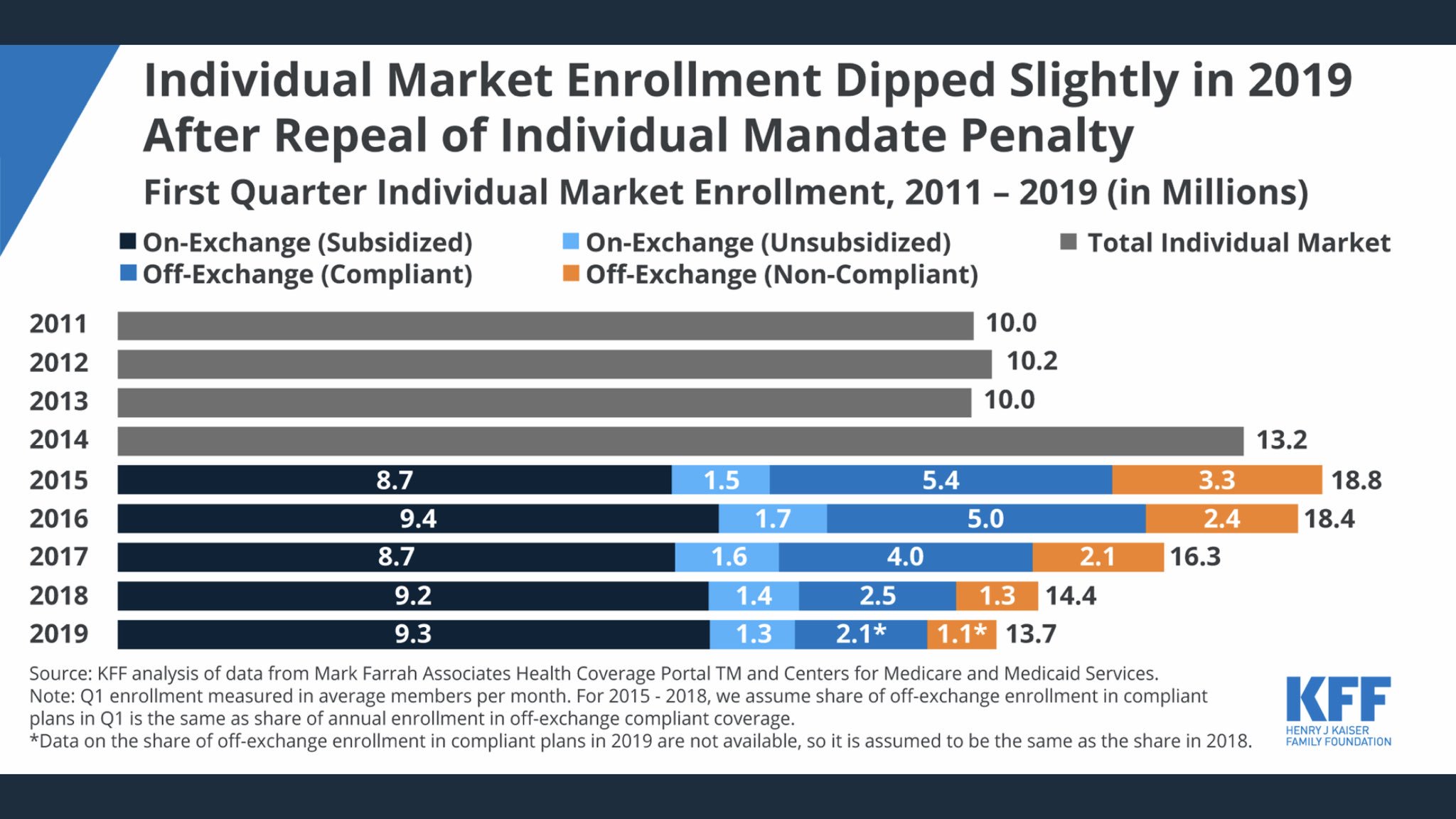

The individual market is 37% larger than it was in 2013. That’s because the federal govt is covering much of people’s premiums, not because we added “protections” which drive up base premium rates. https://t.co/wd4UdvwbEp https://t.co/llUlFKLwqJ— Greg Fann (@greg_fann) August 23, 2019

Or more succinctly:

#ImagineThat

Monday, August 26, 2019

Bending that cost curve down: MVNHS©-style

Hard to beat this:

Well yes. A study of cataract surgery in the UK showed that delaying surgery at least a year resulted in many patients dying, becoming too sick or forgetting about it so the numbers of actual procedures were reduced. It is a form of self-rationing then allows access to others.— kokomored (@kokomored1) August 22, 2019

The study found that patients "with poor eyesight are being forced to wait almost six months for operations ... Lengthening delays and the growing demand for cataract operations are forcing the NHS to send increasing numbers of patients to be treated privately."

But I thought the Much Vaunted National Health Service© was the 'ne plus ultra ' of government run health "care."

Hunh.

But I thought the Much Vaunted National Health Service© was the 'ne plus ultra ' of government run health "care."

Hunh.

Friday, August 23, 2019

Rock and Hard Place: Grandpa edition

Well, technically "Grandfathered:" the plan in question dates from 2010, when we wrote it for a younger couple and their 3 (now 4) children. This was one of my favorite plan designs: Anthem's Lumenos HSA product, a legit cat (catastrophic) plan with a $10,000 family deductible, then 100% after. Fit their needs well, and was a great value.

Fast forward 9 years, and (sadly) they're divorcing. Which wouldn't be the end of the world insurance-wise but for a couple complications:

First, now ex-hubby has opted for a Sharing Ministry for himself and the kids, and has failed to pay the August premium. Oh, did I mention that I just learned about all this yesterday?

/sigh

Anyway, Jane reached out to me to fill me in and to ask about her options, . since she would prefer an actual insurance plan. It doesn't look like she'd be eligible for a Special Open Enrollment opportunity (since her plan isn't ACA-compliant), but perhaps she could keep the Lumenos/Anthem plan?

So I reached out to Anthem and learned that she could, in fact, keep the plan (there are some hoops through which she'll need to jump, including getting ex-hubby's signature on the change request).

So what's the dilemma, Henry?

Well, since the August premium is apparently unpaid, the plan is in the 30 day grace period, and that clock is ticking. Once that's over, so's the plan, and the opportunity to keep it. In the meantime, she's waiting to learn whether or not she's been approved for the new job for which she's applied, but won't know that until the 30th.

Which is also the deadline for the change request.

Yikes.

I've suggested that she submit the request anyway, since it doesn't involve sending in any actual money, and she can always change her mind if/when she gets that new gig.

Meantime, it's wait and see.

Fast forward 9 years, and (sadly) they're divorcing. Which wouldn't be the end of the world insurance-wise but for a couple complications:

First, now ex-hubby has opted for a Sharing Ministry for himself and the kids, and has failed to pay the August premium. Oh, did I mention that I just learned about all this yesterday?

/sigh

Anyway, Jane reached out to me to fill me in and to ask about her options, . since she would prefer an actual insurance plan. It doesn't look like she'd be eligible for a Special Open Enrollment opportunity (since her plan isn't ACA-compliant), but perhaps she could keep the Lumenos/Anthem plan?

So I reached out to Anthem and learned that she could, in fact, keep the plan (there are some hoops through which she'll need to jump, including getting ex-hubby's signature on the change request).

So what's the dilemma, Henry?

Well, since the August premium is apparently unpaid, the plan is in the 30 day grace period, and that clock is ticking. Once that's over, so's the plan, and the opportunity to keep it. In the meantime, she's waiting to learn whether or not she's been approved for the new job for which she's applied, but won't know that until the 30th.

Which is also the deadline for the change request.

Yikes.

I've suggested that she submit the request anyway, since it doesn't involve sending in any actual money, and she can always change her mind if/when she gets that new gig.

Meantime, it's wait and see.

The Infallibility of Doctors' “Mindset”

The ongoing saga of Mount

Carmel Health System in my home state of Ohio should be a wakeup

call for all Medical Organizations. Specifically, that Doctors are fallible.

But to the root of the problem, how did this happen. It happened because Medical Organizations are created by Doctors who have a "negativity bias."

How does the negativity bias affect patient care? Catherine Hambley, PhD discusses this in an article, “What you can do about the negativity bias in Medicine.

This trait is then carried over into their working lives and into the Medical Practices and Organizations in which they create and work. Staff is expected to maintain this super human level of perfection, which causes tremendous stress and burn out. As Dr. Hambley states:

I have seen this negativity time and again in the Medical Profession. Staff are intimidated not to complain about the “Bad Doctor” because they have seen their peers who do complain punished. In job interviews I am always asked about dealing with the “Bad Doctor”. I always know when that question is coming because the interviewer becomes quiet, usually sighs or breaths in audibly, and then tentatively begins the question. The question is asked because there is a “Bad Doctor” in the organization that has been ignored, supported, and accommodated when in reality he/she should have been acknowledged, discouraged, and censored.

What happens instead is that good, ethical employees become jaundiced to management, which effects their job performance and ultimately leads to less than adequate care. The case of Mount Carmel is the extreme, but it will happen again as long as the Infallibility Mindset is a part of Medical Management.

But to the root of the problem, how did this happen. It happened because Medical Organizations are created by Doctors who have a "negativity bias."

How does the negativity bias affect patient care? Catherine Hambley, PhD discusses this in an article, “What you can do about the negativity bias in Medicine.

“The negativity bias is alive and well in medicine. It starts in medical school where students are frequently exposed to teaching methods that create feelings of shame, ineptitude and incompetency. Early on in their careers, physicians learn both the importance of preventing and avoiding errors as well as the need for perfection.”

This trait is then carried over into their working lives and into the Medical Practices and Organizations in which they create and work. Staff is expected to maintain this super human level of perfection, which causes tremendous stress and burn out. As Dr. Hambley states:

“…we know that mistakes are inevitable. We also know that if we talk about them, we are more likely to prevent their recurrence. The problem is that healthcare workers often avoid acknowledging that an error has occurred. This is typically due to a culture where mistakes are accompanied by some form of punishment, and people often feel humiliated and blamed. Hospital settings can also perpetuate a culture where the negativity bias is enhanced with physician peer review committees and incident reporting systems.”

I have seen this negativity time and again in the Medical Profession. Staff are intimidated not to complain about the “Bad Doctor” because they have seen their peers who do complain punished. In job interviews I am always asked about dealing with the “Bad Doctor”. I always know when that question is coming because the interviewer becomes quiet, usually sighs or breaths in audibly, and then tentatively begins the question. The question is asked because there is a “Bad Doctor” in the organization that has been ignored, supported, and accommodated when in reality he/she should have been acknowledged, discouraged, and censored.

What happens instead is that good, ethical employees become jaundiced to management, which effects their job performance and ultimately leads to less than adequate care. The case of Mount Carmel is the extreme, but it will happen again as long as the Infallibility Mindset is a part of Medical Management.

Thursday, August 22, 2019

Telemedicine in the News

We last blogged on telemedicine last Fall:

"[U]nlimited same-day/next-day doctor appointments for acute issues at $10 a visit and around-the-clock telemedicine for no out-of-pocket cost."

It was in that post that we first learned the newest buzz-phrase "Virtual Primary Care."

Anyway, fast forward a bit, and now the feature will be a required benefit in health insurance plans marketed here in The Buckeye State:

"Private insurance companies in Ohio are now required to cover doctor visits over the phone or on the computer."

The new reg is touted as a benefit to both consumers (for convenience) and providers (who will now be assured of reimbursement):

"Doctors have been anxious to include telemedicine in their practice but until law guaranteed insurance payments, some were reluctant to purchase equipment and learn how to do it."

Quite so.

"[U]nlimited same-day/next-day doctor appointments for acute issues at $10 a visit and around-the-clock telemedicine for no out-of-pocket cost."

It was in that post that we first learned the newest buzz-phrase "Virtual Primary Care."

Anyway, fast forward a bit, and now the feature will be a required benefit in health insurance plans marketed here in The Buckeye State:

"Private insurance companies in Ohio are now required to cover doctor visits over the phone or on the computer."

The new reg is touted as a benefit to both consumers (for convenience) and providers (who will now be assured of reimbursement):

"Doctors have been anxious to include telemedicine in their practice but until law guaranteed insurance payments, some were reluctant to purchase equipment and learn how to do it."

Quite so.

Of course, no one's addressing the actual elephant in the room: who pays for this?

If you guessed "I, the policyholder, will be paying for it with increased premiums," please collect your winnings at the ticket window to your left.

[Hat Tp: FoIB Bill M]

If you guessed "I, the policyholder, will be paying for it with increased premiums," please collect your winnings at the ticket window to your left.

[Hat Tp: FoIB Bill M]

Terrible Carrier Tricks: Policy Holder Service edition

One of my life insurance clients called the other day to see if I could help her with her sons' policies. Seems she had bought each of them a Universal Life policy some years ago (before we'd met) and she wanted to professional advice. I was of course happy to oblige, and asked her a few questions:

The plans were about 20 or so years old, and written by her Auto Owners Insurance agent. He has since retired, and the agency to which the plans were re-assigned hasn't been particularly helpful. She did have the annual statements handy, and we were able to determine that the plans were doing well so far (a welcome relief: they often get "upside down" this far in). But it seemed to me that it wouldn't hurt to increase the premium a bit as a hedge against future slumps. To that end, I suggested that she contact AO directly to see about obtaining in-force illustrations (aka "what-ifs") for each plan.

Here's why: due to various tax laws over the years, there is a cap on how much one can put into a given UL each year (yeah. I think that's dumb, too, but there you go). So we needed to determine if we could bump the premiums, and if so, to what effect. Quite routine, really.

What happened next is decidedly not routine: when she called the Home Office, she was told that only her agent could order these illustrations. Putting aside the obvious question of what if she had no agent, why is it the carrier's business if she wanted them? As the owner of the policies, she has every right to this information (as well as changing beneficiaries, premiums, etc).

And even if she wasn't the owner, she should have been told that her sons would need to make the request themselves (not her on their behalf). There's just no excuse for how poorly this was handled. One wonders how she would have been treated if it was a claim.

Shame on Auto Owners Insurance.

[ed: we generally like to give carriers a heads' up on, and opportunity to correct, these types of issues, but AO doesn't seem to have a media relations contact email available]

The plans were about 20 or so years old, and written by her Auto Owners Insurance agent. He has since retired, and the agency to which the plans were re-assigned hasn't been particularly helpful. She did have the annual statements handy, and we were able to determine that the plans were doing well so far (a welcome relief: they often get "upside down" this far in). But it seemed to me that it wouldn't hurt to increase the premium a bit as a hedge against future slumps. To that end, I suggested that she contact AO directly to see about obtaining in-force illustrations (aka "what-ifs") for each plan.

Here's why: due to various tax laws over the years, there is a cap on how much one can put into a given UL each year (yeah. I think that's dumb, too, but there you go). So we needed to determine if we could bump the premiums, and if so, to what effect. Quite routine, really.

What happened next is decidedly not routine: when she called the Home Office, she was told that only her agent could order these illustrations. Putting aside the obvious question of what if she had no agent, why is it the carrier's business if she wanted them? As the owner of the policies, she has every right to this information (as well as changing beneficiaries, premiums, etc).

And even if she wasn't the owner, she should have been told that her sons would need to make the request themselves (not her on their behalf). There's just no excuse for how poorly this was handled. One wonders how she would have been treated if it was a claim.

Shame on Auto Owners Insurance.

[ed: we generally like to give carriers a heads' up on, and opportunity to correct, these types of issues, but AO doesn't seem to have a media relations contact email available]

Wednesday, August 21, 2019

(Very) Mixed Feelings

Don't know how I missed this [ed: yes I do, it flew completely under the radar] but:

"Simple Health claimed to offer comprehensive health insurance or PPOs that would cover many medical needs, but instead sold only medical discount memberships, limited benefit plans, and other products that provide a small reimbursement or discount for a few services."

And then folks started to complain.

A lot.

I've used the marketing company, Health Insurance Innovations, for various short term medical plans, but thankfully never used their Simple Health "plan."

Anyway, the cacophony has apparently reached a crescendo, and the Rocket Surgeons in DC© have opened up a Special Open Enrollment Period (SEP) for folks who've been bamboozled:

"The SEP will run from July 1, 2019 until September 4, 2019. Eligible consumers should have received a notice ... advising them of the availability of this SEP. CMS will evaluate an individual’s eligibility for the SEP using Simple Health Plan enrollment information."

Oh goody.

Here's why I'm ambivalent about this:

There were plenty of folks who played by the rules of the game and bought legit policies who were then left high and dry. Why are the SHP folks given preferential treatment? Perhaps it's because the FTC is suing the carrier, but what does that have to do with CMS?

"They bought their tickets..."

"Simple Health claimed to offer comprehensive health insurance or PPOs that would cover many medical needs, but instead sold only medical discount memberships, limited benefit plans, and other products that provide a small reimbursement or discount for a few services."

And then folks started to complain.

A lot.

I've used the marketing company, Health Insurance Innovations, for various short term medical plans, but thankfully never used their Simple Health "plan."

Anyway, the cacophony has apparently reached a crescendo, and the Rocket Surgeons in DC© have opened up a Special Open Enrollment Period (SEP) for folks who've been bamboozled:

"The SEP will run from July 1, 2019 until September 4, 2019. Eligible consumers should have received a notice ... advising them of the availability of this SEP. CMS will evaluate an individual’s eligibility for the SEP using Simple Health Plan enrollment information."

Oh goody.

Here's why I'm ambivalent about this:

There were plenty of folks who played by the rules of the game and bought legit policies who were then left high and dry. Why are the SHP folks given preferential treatment? Perhaps it's because the FTC is suing the carrier, but what does that have to do with CMS?

"They bought their tickets..."

Tuesday, August 20, 2019

UHC Jumps in the Pol

The MEWA pool that is:

"Previously only available to larger employers, the Ohio Chamber Health Benefit Program now provides small businesses access to features from UnitedHealthcare Primary Advantage® plans."

Like its competitors from Anthem and Medical Mutual of Ohio, this plan (which is yet to be released in the wild) will require membership in a local Chamber of Commerce, and will likely offer the potential of better rates than off-the-shelf ObamaGroup plans.

How's that, you ask?

Well, unlike ACA plans, these are medically underwritten, so healthier groups benefit from actual risk assessment (instead of one-size-fits-all Community Rating).

So far, though, it's vaporware.

Will be interesting to see how it stacks up with already established plans.

"Previously only available to larger employers, the Ohio Chamber Health Benefit Program now provides small businesses access to features from UnitedHealthcare Primary Advantage® plans."

Like its competitors from Anthem and Medical Mutual of Ohio, this plan (which is yet to be released in the wild) will require membership in a local Chamber of Commerce, and will likely offer the potential of better rates than off-the-shelf ObamaGroup plans.

How's that, you ask?

Well, unlike ACA plans, these are medically underwritten, so healthier groups benefit from actual risk assessment (instead of one-size-fits-all Community Rating).

So far, though, it's vaporware.

Will be interesting to see how it stacks up with already established plans.

Monday, August 19, 2019

Top o'the week Spindle Clearing

■ While we continue the rush to implement #Medicaid4All here in the States, it's instructive to see how that's working out for our Neighbors to the North©:

"[M]ore than 63,000 Canadians left their country to have surgery in 2016."

As Americans contemplate overturning our health system in favor of one similar to Canada’s, we must ask why so many leave.

Oh!

"After being advised that they need a procedure done, only about 35% of Canadians had their surgery within a month."

Why do Bernie, Elizabeth and the rest of the field hate Canucks?

■ This isn't really "news" to those of us who've been paying attention, but:

"End of ‘individual mandate’ hasn’t killed Obamacare"

It's always been about the Benjamins (both premiums and cost-sharing).

■ The Much Vaunted National Health Service© continues to cover itself with glory:

"GP surgeries in England ordered to stop half-day closing Practices will have to seek permission to close during working hours, or risk losing funding worth more than £40,000."

Heh.

The backstory here is that it turns out that [WARNING: Spoiler Alert ahead] nationalized health "care" schemes aren't very good at actually providing medical care.

#ImagineThat

■ Bonus Item: Meanwhile, back here in flyover country, insurers and hospitals are beginning to meaningfully address "shock claims" to employers with group plans:

"St. Elizabeth Healthcare is the first hospital system in Greater Cincinnati to partner with Anthem Blue Cross and Blue Shield to help patients and their employers limit so-called shock claims, which can cost $1 million or more to treat a catastrophic illness such as cancer."

As regular readers know, in recent years the "number of million-dollar medical claims has nearly doubled, with cancer care remaining the most costly health condition."

So this new collaboration is welcome news, if only for folks covered under certain group plans.

[Hat Tip: FoIB Holly R]

"[M]ore than 63,000 Canadians left their country to have surgery in 2016."

As Americans contemplate overturning our health system in favor of one similar to Canada’s, we must ask why so many leave.

Oh!

"After being advised that they need a procedure done, only about 35% of Canadians had their surgery within a month."

Why do Bernie, Elizabeth and the rest of the field hate Canucks?

■ This isn't really "news" to those of us who've been paying attention, but:

"End of ‘individual mandate’ hasn’t killed Obamacare"

It's always been about the Benjamins (both premiums and cost-sharing).

■ The Much Vaunted National Health Service© continues to cover itself with glory:

"GP surgeries in England ordered to stop half-day closing Practices will have to seek permission to close during working hours, or risk losing funding worth more than £40,000."

Heh.

The backstory here is that it turns out that [WARNING: Spoiler Alert ahead] nationalized health "care" schemes aren't very good at actually providing medical care.

#ImagineThat

■ Bonus Item: Meanwhile, back here in flyover country, insurers and hospitals are beginning to meaningfully address "shock claims" to employers with group plans:

"St. Elizabeth Healthcare is the first hospital system in Greater Cincinnati to partner with Anthem Blue Cross and Blue Shield to help patients and their employers limit so-called shock claims, which can cost $1 million or more to treat a catastrophic illness such as cancer."

As regular readers know, in recent years the "number of million-dollar medical claims has nearly doubled, with cancer care remaining the most costly health condition."

So this new collaboration is welcome news, if only for folks covered under certain group plans.

[Hat Tip: FoIB Holly R]

Important ACA insight

Thanks to co-blogger Patrick P: He says to pay particular attention to the 2nd sentence:

ACA's exchange is basically an entitlement, not an insurance product. It's worth bearing in mind, this was all *before* mandate repeal and STLDI deregulation went into effect: https://t.co/nLF8xGSxV5 pic.twitter.com/wztJmhoJcl— Chris Pope (@CPopeHC) August 12, 2019

The more you know...

Friday, August 16, 2019

A Billing “Never Event”

In medical terms, a “Never Event” is an event that should never

happen, like a wrong site surgery or killing a patient. An article in today’s

medical reading clearly demonstrates a real time Billing Never Event, that unfortunately

occurs much too often in medical clinics.

According to WCPO in Cincinnati (OH), a mom had to be pay a bill before her daughter would be seen at a walk in clinic.

The story begins:

“Jessica Vance wanted to avoid a $1,000-plus emergency room bill, when her 8-year old daughter recently developed a cough and fever.

So she took her to a walk-in clinic inside a local grocery store.”

Problem number one: Why doesn’t this family have a Family Practice Doctor? One of the cited reasons for America’s high health costs is the use of Emergency Rooms for non-emergent conditions, such as this case. If mom had established herself with a Family Practice Doctor, she would have either been seen that day, or at the very least prescribed a medication with a follow up visit, for the cost of a co-payment.

But I digress, let’s continue the saga:

“But when Vance spoke to the woman at the desk, she received some stunning news. The employee said Vance had a $690 unpaid balance, from an insurance payment that had not yet processed.

According to WCPO in Cincinnati (OH), a mom had to be pay a bill before her daughter would be seen at a walk in clinic.

The story begins:

“Jessica Vance wanted to avoid a $1,000-plus emergency room bill, when her 8-year old daughter recently developed a cough and fever.

So she took her to a walk-in clinic inside a local grocery store.”

Problem number one: Why doesn’t this family have a Family Practice Doctor? One of the cited reasons for America’s high health costs is the use of Emergency Rooms for non-emergent conditions, such as this case. If mom had established herself with a Family Practice Doctor, she would have either been seen that day, or at the very least prescribed a medication with a follow up visit, for the cost of a co-payment.

But I digress, let’s continue the saga:

“But when Vance spoke to the woman at the desk, she received some stunning news. The employee said Vance had a $690 unpaid balance, from an insurance payment that had not yet processed.

So the employee said Vance's daughter could not see the

nurse, and suggested they go to an emergency room if they needed immediate

help.

"I said 'what do you meant you won't see her?' Vance said. "They told me I have a balance due. I asked them 'can't you call insurance?' They said no, they could not."

So she reluctantly she put the past due amount on her credit card, rather than drive across town to an emergency room, and a much larger bill.

"I ended up having to pay $690 that day for her to be seen," Vance said.”

This is where the clinic made its mistake, and it is a huge mistake. Yes, clinics, doctors, etc. can refuse care for non-emergent cases when the patient has a balance due. However, in this case there was not a balance due. Let’s look at the sentence again:

“Vance had a $690 unpaid balance, from an insurance payment that had not yet processed”

If the claim had not yet been processed by the insurance company, there is no balance for the patient to pay. When a medical entity agrees to be an in-network provider, which means that the entity agrees in a contract to submit claims to an insurance company for payment and not collect from the patient at time of service, then the patient cannot be billed for any monies owed until that claim is processed. The clinic violated the contract with the Insurance Company and as such the Insurance Company has grounds to nullify that contract, resulting in the clinic becoming a non-participating provider.

Now to make matters worse, the article reports that the Insurance Company paid the balance due in full but mom has not yet been reimbursed the funds. This is the ultimate insult.

While a clinic has a right to deny treatment based on an unpaid balance, the patient would have to be notified in writing that this was the policy and the patient would have to sign a document acknowledging that policy. (When I manage an office, my Policy and Procedure Contract with Patients is about 11 pages long.) Without that signed documentation, the clinic cannot deny treatment based on monies due, as this is outside the contract that the Patient and the Insurance Company have with the provider.

"I said 'what do you meant you won't see her?' Vance said. "They told me I have a balance due. I asked them 'can't you call insurance?' They said no, they could not."

So she reluctantly she put the past due amount on her credit card, rather than drive across town to an emergency room, and a much larger bill.

"I ended up having to pay $690 that day for her to be seen," Vance said.”

This is where the clinic made its mistake, and it is a huge mistake. Yes, clinics, doctors, etc. can refuse care for non-emergent cases when the patient has a balance due. However, in this case there was not a balance due. Let’s look at the sentence again:

“Vance had a $690 unpaid balance, from an insurance payment that had not yet processed”

If the claim had not yet been processed by the insurance company, there is no balance for the patient to pay. When a medical entity agrees to be an in-network provider, which means that the entity agrees in a contract to submit claims to an insurance company for payment and not collect from the patient at time of service, then the patient cannot be billed for any monies owed until that claim is processed. The clinic violated the contract with the Insurance Company and as such the Insurance Company has grounds to nullify that contract, resulting in the clinic becoming a non-participating provider.

Now to make matters worse, the article reports that the Insurance Company paid the balance due in full but mom has not yet been reimbursed the funds. This is the ultimate insult.

While a clinic has a right to deny treatment based on an unpaid balance, the patient would have to be notified in writing that this was the policy and the patient would have to sign a document acknowledging that policy. (When I manage an office, my Policy and Procedure Contract with Patients is about 11 pages long.) Without that signed documentation, the clinic cannot deny treatment based on monies due, as this is outside the contract that the Patient and the Insurance Company have with the provider.

Thursday, August 15, 2019

More face-palming?

Oh yeah:

So what does this mean, exactly?

Well:

ACA-compliant plans have certain features and rules, one of which is that chronic care can't be considered a first-dollar expense. That is, unlike, say, a routine physical, chronic expenses must first be applied to one's deductible and co-insurance (if any). Turns out that a lot of folks who actually suffer from these issues would like relief from this requirement.

This becomes a problem for HSA policy holders, because doing that would render their plans non-compliant (and result in all kinds of nasty consequences). And so, the generous folks at the IRS have issued a ruling that reverses (or negates) that, and specifically allows such plans to cover some chronic expenses "first dollar."

Which is nice, but just as insurance ≠ care, coverage ≠ "free."

Hunh?

Well, according to the folks at Snell & Wilmer, this notice now provides "free preventive care for certain chronic conditions."

Really?

And how do the physicians who actually provide it feel about working gratis?

And then this little gem:

"Employers that want to take advantage of these new rules may need to adopt plan amendments and prepare employee communications explaining the new rules."

Oh, because compliance is already such a bargain; I'm sure they're just chompin' at the bit.

Preventive Care Can Now Be Covered for Specified Chronic Conditions Before HDHP Deductible https://t.co/TTjgEGqf3q— Healthcare Reform (@Health_Reforms) August 12, 2019

So what does this mean, exactly?

Well:

ACA-compliant plans have certain features and rules, one of which is that chronic care can't be considered a first-dollar expense. That is, unlike, say, a routine physical, chronic expenses must first be applied to one's deductible and co-insurance (if any). Turns out that a lot of folks who actually suffer from these issues would like relief from this requirement.

This becomes a problem for HSA policy holders, because doing that would render their plans non-compliant (and result in all kinds of nasty consequences). And so, the generous folks at the IRS have issued a ruling that reverses (or negates) that, and specifically allows such plans to cover some chronic expenses "first dollar."

Which is nice, but just as insurance ≠ care, coverage ≠ "free."

Hunh?

Well, according to the folks at Snell & Wilmer, this notice now provides "free preventive care for certain chronic conditions."

Really?

And how do the physicians who actually provide it feel about working gratis?

And then this little gem:

"Employers that want to take advantage of these new rules may need to adopt plan amendments and prepare employee communications explaining the new rules."

Oh, because compliance is already such a bargain; I'm sure they're just chompin' at the bit.

Wednesday, August 14, 2019

Free Health "Care"

Courtesy of our Neighbors to the North©:

But hey: Free!

Father with ALS Euthanized after Denied Sufficient Care https://t.co/od9XSD5Bfi— Þe Political Hat (@ThePoliticalHat) August 14, 2019

But hey: Free!

It's that time of year again...

When Summer starts to fade, and we cast our eyes on Fall and the annual Breast Cancer Awareness Walk.

Our friends (and teammates) at InsuranceWorks are kicking off their efforts early:

"Insurance Works for You! Is giving you an opportunity to DONATE to Making Strides against Cancer Walk without asking you for money.

If you call or e-mail between September 1st and September 30th and request an insurance quote for Life, Home or Auto Coverage. we will donate $ 1.00 for each quote completed.

Call at 937-424-5633 or email and mention the American Cancer Society."

Our friends (and teammates) at InsuranceWorks are kicking off their efforts early:

"Insurance Works for You! Is giving you an opportunity to DONATE to Making Strides against Cancer Walk without asking you for money.

If you call or e-mail between September 1st and September 30th and request an insurance quote for Life, Home or Auto Coverage. we will donate $ 1.00 for each quote completed.

Call at 937-424-5633 or email and mention the American Cancer Society."

Gun Insurance: Oy

The stupid, it burns:

"[T]he mayor of San Jose, Calif., on Monday proposed what is being called a first-in-the-nation move to require all gun owners to carry liability insurance for their weapons."

Really?

And how would that work?

Oh:

"[T]he insurance would cover any accidental discharge of a firearm and any intentional acts carried out by a person who has stolen or borrowed the gun. It would not cover the policyholder for any intentional discharge that he or she carries out."

So let me get this right: I would be forced to buy an insurance policy (that does not, in fact, actually exist) to cover the illegal actions of a person who steals my firearm? Do I have that correct? How many pills did you actually take?

We've written about the concept of CCW insurance and the like for quite a while. Here for instance:

"The United States Concealed Carry Association (USCCA) provides a policy for its members designed to provide immediate assistance after an incident."

The "catch," of course, is that it protects only the licensed CCW holder, and even then only for his or her intentional act of self defense.

In other words, Hizzoner wants to require legal gun owners to buy a product that if it actually existed would be of zero benefit to themselves.

And how does he justify this?

Pure rocket surgery:

"Liccardo said that his plan is based on similar laws in California that make it illegal to drive a vehicle without insurance."

No, it does not. Like every other state, it requires one to have insurance if, and only if, one intends to drive on public thoroughfares. I would also love for him to identify which Constitutional penumbra relates to driving a car.

I'll wait.

"[T]he mayor of San Jose, Calif., on Monday proposed what is being called a first-in-the-nation move to require all gun owners to carry liability insurance for their weapons."

Really?

And how would that work?

Oh:

"[T]he insurance would cover any accidental discharge of a firearm and any intentional acts carried out by a person who has stolen or borrowed the gun. It would not cover the policyholder for any intentional discharge that he or she carries out."

So let me get this right: I would be forced to buy an insurance policy (that does not, in fact, actually exist) to cover the illegal actions of a person who steals my firearm? Do I have that correct? How many pills did you actually take?

We've written about the concept of CCW insurance and the like for quite a while. Here for instance:

"The United States Concealed Carry Association (USCCA) provides a policy for its members designed to provide immediate assistance after an incident."

The "catch," of course, is that it protects only the licensed CCW holder, and even then only for his or her intentional act of self defense.

In other words, Hizzoner wants to require legal gun owners to buy a product that if it actually existed would be of zero benefit to themselves.

And how does he justify this?

Pure rocket surgery:

"Liccardo said that his plan is based on similar laws in California that make it illegal to drive a vehicle without insurance."

No, it does not. Like every other state, it requires one to have insurance if, and only if, one intends to drive on public thoroughfares. I would also love for him to identify which Constitutional penumbra relates to driving a car.

I'll wait.

Tuesday, August 13, 2019

Another Nail

Good news from an Insurer in today’s readings:

“Health insurer Anthem plans to launch a new mobile app that will enable its 40 million members to get quicker access to personalized health information and treatment options.

Well good news for the patient, but it is another nail in the coffin for the Primary Care Physician.

Anthem is using an app, called CareSpree, which will allow patients the ability to put in their symptoms and through AI receive possible diagnosis. Anthem incorporated technology from a digital health company, K Health, to create an artificial intelligence that will offer potential diagnosis based on historic data from medical records. It will take into account the users’ medical history, age, and gender.

“The app will enable Anthem members to see how doctors have diagnosed and treated other patients experiencing similar symptoms. The health information is provided at no cost. Patients can then connect with a doctor via text for follow-up advice for less than the cost of a copay, according to the companies.”

As a Manager in Medical Offices, a major complaint from patients was the cost of their appointment for a simple diagnosis. I explained that the cost for the appointment is based on many factors, one of which was the physician’s time and expertise in diagnosing their problem. In terms of coding, this is called “medical decision making”. In essence, you are paying for the knowledge of a physician that he/she is utilizing in your medical care.

Anthem has removed that cost by creating an AI that has all the knowledge of your doctor and hundreds of others.

Allon Bloch, CEO and co-founder of K Health, summed it up best:

“We developed a platform that allows us to use real data from the real world to offer potential diagnosis and treatment options and that costs less than a primary care visit today”.

Now a patient can, in real time, utilize the app to diagnose their symptoms, text with a doctor about treatments and receive a prescription if needed, schedule a follow up appointment with a specialist and even schedule labs and testing if the situation warrants it.

If this works as promised, it will be a game changer for the Private Practice Primary Care Physician. Urgent Cares, Walk-In Clinics, and the utilization of Mid-Level Providers (i.e. Nurse Practitioners) have already taken a toll on their patient base and finances. As another nail is pounded in, the next faster, cheaper, mode of delivering medical care is waiting around the corner, with another nail.

“Health insurer Anthem plans to launch a new mobile app that will enable its 40 million members to get quicker access to personalized health information and treatment options.

Through the app, members also will be able to text

with a doctor at a lower cost than visiting a physician's office.”

Well good news for the patient, but it is another nail in the coffin for the Primary Care Physician.

Anthem is using an app, called CareSpree, which will allow patients the ability to put in their symptoms and through AI receive possible diagnosis. Anthem incorporated technology from a digital health company, K Health, to create an artificial intelligence that will offer potential diagnosis based on historic data from medical records. It will take into account the users’ medical history, age, and gender.

“The app will enable Anthem members to see how doctors have diagnosed and treated other patients experiencing similar symptoms. The health information is provided at no cost. Patients can then connect with a doctor via text for follow-up advice for less than the cost of a copay, according to the companies.”

As a Manager in Medical Offices, a major complaint from patients was the cost of their appointment for a simple diagnosis. I explained that the cost for the appointment is based on many factors, one of which was the physician’s time and expertise in diagnosing their problem. In terms of coding, this is called “medical decision making”. In essence, you are paying for the knowledge of a physician that he/she is utilizing in your medical care.

Anthem has removed that cost by creating an AI that has all the knowledge of your doctor and hundreds of others.

Allon Bloch, CEO and co-founder of K Health, summed it up best:

“We developed a platform that allows us to use real data from the real world to offer potential diagnosis and treatment options and that costs less than a primary care visit today”.

Now a patient can, in real time, utilize the app to diagnose their symptoms, text with a doctor about treatments and receive a prescription if needed, schedule a follow up appointment with a specialist and even schedule labs and testing if the situation warrants it.

If this works as promised, it will be a game changer for the Private Practice Primary Care Physician. Urgent Cares, Walk-In Clinics, and the utilization of Mid-Level Providers (i.e. Nurse Practitioners) have already taken a toll on their patient base and finances. As another nail is pounded in, the next faster, cheaper, mode of delivering medical care is waiting around the corner, with another nail.

Subscribe to:

Posts (Atom)