News flash: ACA exchanges are open and all states have Special Enrollment Periods!

In a day and age when 240 characters is our limit for reading news, it becomes very important that we don't overlook the facts within the story. Unfortunately our media outlets would rather garner clicks and scare people than provide a real understanding of what people can do.

Look at these headlines:

Trump Rejects Obamacare Special Enrollment Period Amid Pandemic - Politico

Trump Rejects Opening Obamacare Enrollment for Uninsured Americans - Fox Business News

Obamacare Markets Will Not Reopen, Trump Decides - New York Times

The list goes on: The Daily Beast, Salon, Business Insider, NBC, all have headlines that create fear.

This shameful tactic is bad enough during normal times, but playing on people's emotions during a pandemic where many are losing their jobs and their benefits is downright f'ed up.

Instead of dwelling on a lost cause, I would like to share the facts. Not only the facts as it relates to Special Enrollment Periods (SEP) being available, but also the challenges an individual faces when signing up for coverage.

An SEP is an enrollment opportunity for individuals dealing with certain life events including losing health coverage, moving, getting married, having a baby, or adopting a child. Aside from an SEP, someone may also qualify for COBRA (likely high cost) or Medicaid/CHIP (income limits apply).

For now we will focus on losing health coverage.

When you lose your job you have 60 days before or 60 days following the event to enroll in a plan. To enroll you need to create an account at

Healthcare.gov (or your state's exchange platform). When creating an account you are asked quite a bit about your demographics. Answering these questions are essential to your account and don't require much heavy lifting to complete.

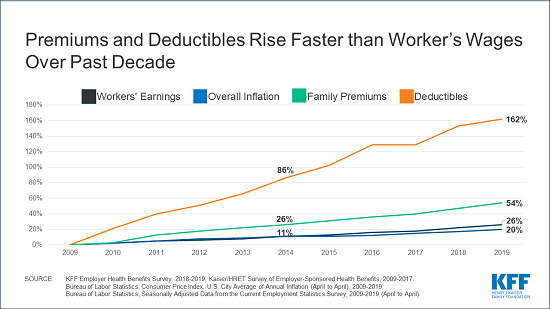

The more challenging parts of the application process deal with providing your projected income, understanding your results, and uploading the proper documents to finalize your insurance.

During the application process you will be asked to provide your projected income for the year. This is the first challenge as nobody knows how much they will make in the future. It's important to note that many

sources of income count including wages, tips, income from investments/rentals, Social Security, retirement/pensions, and

unemployment. I highlight the last because it will likely be a focus for those losing employer based insurance.

Once you have completed the basic sections you will be able to "review your results". It is here where you find out if you qualify for a subsidy or not. Also in this document will be details on what you need to provide as proof you are losing insurance coverage. This document - once you receive it - will have to be uploaded and sent to healthcare.gov.

Documents that can be submitted include a letter from the health insurance company, a letter from your employer, a letter regarding COBRA, or many others based on your situation.

From here you will determine how much of your subsidy you want to use on a monthly basis (we recommend all of it), review all plans and prices, make a plan selection, and then pay your initial premium.

It's important to remember that if you have already lost insurance that you must pick a plan within 60 days of losing coverage, submit documents within 30 days of picking a plan, and your new plan won't start until the first of the month after you have picked a plan.

This is a very cumbersome process for most and there are many pitfalls that come along with trying to navigate the website on your own. Above everything I would recommend finding a licensed agent in your area to help you through the process. In many areas there is no cost for this assistance as compensation is built in to the insurance premiums you pay.

One last note, if you are looking for insurance make sure you complete the process within the required timeframe. Failing to do so will result in you having to wait until open enrollment which doesn't start your coverage until January 1, 2021.