Drew Calver took out his trash cans and then waved goodbye to his wife, Erin, as she left for the grocery store the morning that upended his picture-perfect life.

Minutes later, the popular high school history teacher and swim coach in Austin, Texas, collapsed in his bedroom from a heart attack. He pounded his fist on the bed frame, violent chest pains pinning him to the floor.

The next day, doctors implanted stents in his clogged “widow-maker” artery. -

Kaiser Health Network

Drew didn't know it but he was about to enter the world of balance billing.

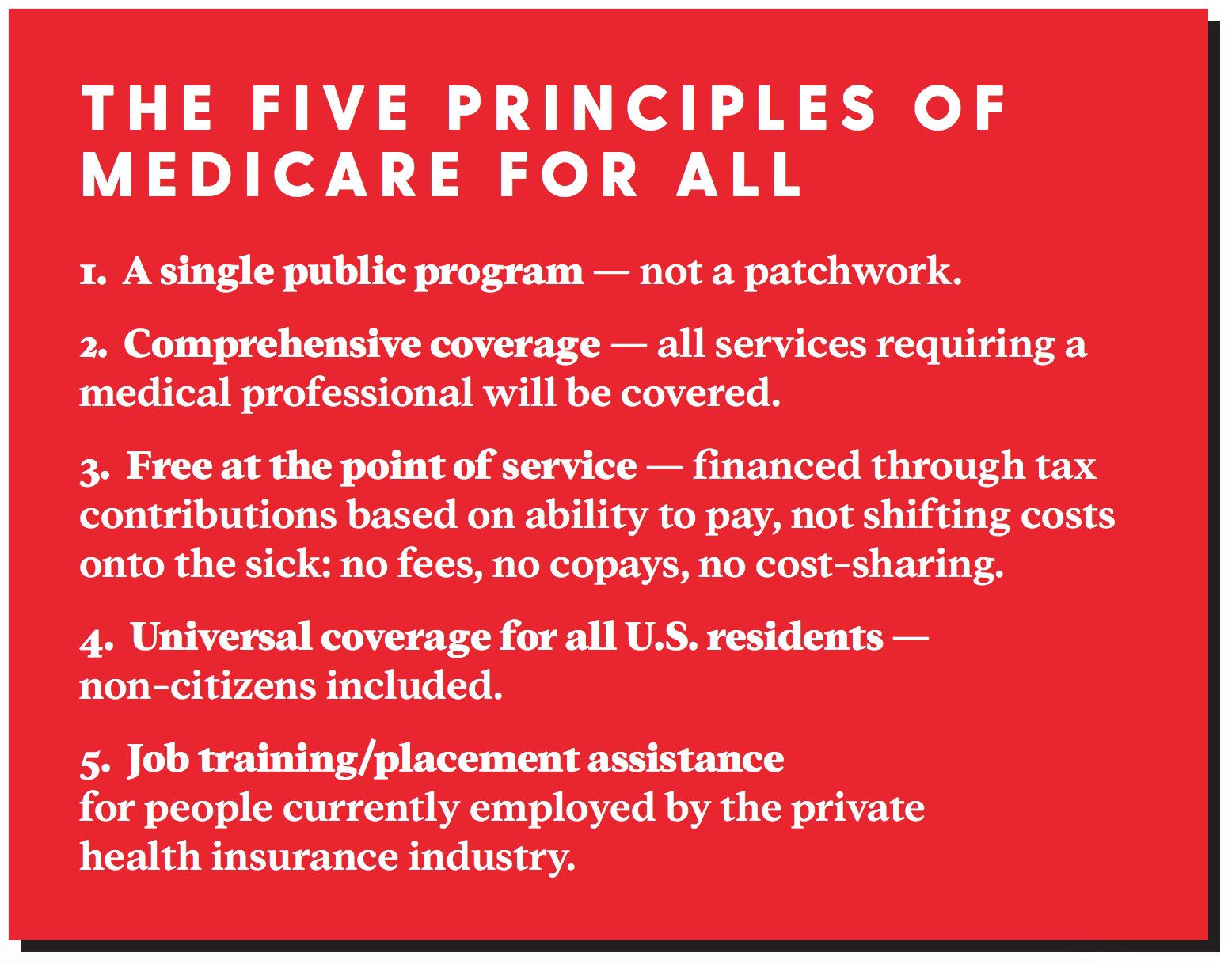

Managed care can quickly become mangled care without warning. First created by Congress in 1973 as part of the HMO Act. By the early 80's the practice of incentivizing and directing care to "preferred" providers was going mainstream.

The idea of saving money on health care by encouraging those with health insurance to use more "cost effective" avenues of health care may have seemed benign at first but as this monster grew it became punitive.

In the case of Drew Carver, this is what happened.

$164,941 for a four-day hospital stay, including $42,944 for four stents and $10,920 for room charges. Calver’s insurer paid $55,840. The hospital billed Calver for the unpaid balance of $108,951.31.

His insurance did what it was supposed to do, it made a fair and reasonable offer for the care received.

St. David's Healthcare, part of the

HCA system, is not a participating provider in Drew's health plan. Most health care plans have allowances for out of network bills incurred as a result of a

life threatening illness or injury. Many times the non-par penalty is waived by the health care plan and the provider agrees to accept a "reasonable" offer as "paid in full".

That did not happen in this case.

St. David's stuck to their guns and refused to budge. It did not matter that such a large unpaid bill could cause serious financial harm to Mr. Carver.

The hospital wanted what they felt like was a fair price for saving Mr. Carver's life.

In fact, the hospital had the nerve to

blame the Austin School District for offering such

"a narrow network product placed a large portion of the financial responsibility directly on the patient because our hospital was not in-network."

Frankly I am surprised the hospital didn't also blame Drew for having the heart attack at an inconvenient place. Had the attack occurred closer to a participating hospital this would never have been a problem for Drew or St. David's.

Then there is this . . .

Industry analysts and consumer advocates say St. David’s has a reputation for exorbitant billing and for trying to collect big payouts as an out-of-network provider. “This is a well-known, problematic provider. We’ve seen multiple bills from them and they are always highly inflated,

"Always" is quite a damning term but if the shoe fits . . .

A few states, including Texas, have passed laws designed to protect insureds against balance billing.

So why didn't the law protect Drew?

But there’s a huge loophole: Those state-mandated protections typically don’t apply to people, like the Calver family, who get their health coverage from employers that are self-insured, meaning the companies or employers pay claims out of their own funds. Federal law governs most of th ose health plans — and it does not include such protections.

About 60 percent of people with employer health benefits are covered by self-insured plans, but many don’t even know it, since employers typically hire an insurer to administer the plan and employees carry a card bearing the name of Blue Cross Blue Shield or another major insurer.

States have the right to regulate INSURED products issued within the state boundary. But they have no authority over self funded health plans such as the one offered by Austin School District.

Roughly 70% of people turning 65 have coverage through an employer health insurance plan. The linked article claims 60% of those plans are self funded.

That's a lot of folks left out in the cold in situations experienced by Drew Carver.

For all this turmoil and angst it seems there is a happier ending, albeit one that came as a result of public shaming.

UPDATE: Monday, shortly after publication and broadcast of this story by Kaiser Health News and NPR, St. David’s said it was now willing to accept $782.29 to resolve the $108,951 balance because Drew Calver qualifies for its “financial assistance discount.”

The takeaway from this seems to be, if you are covered by a self funded plan and have a medical emergency, don't go to a non-par provider. They may not be as generous and forgiving as St. David's.