■ First up, thanks to FoIB Jeff M, some good news for Tar Heel State insureds:

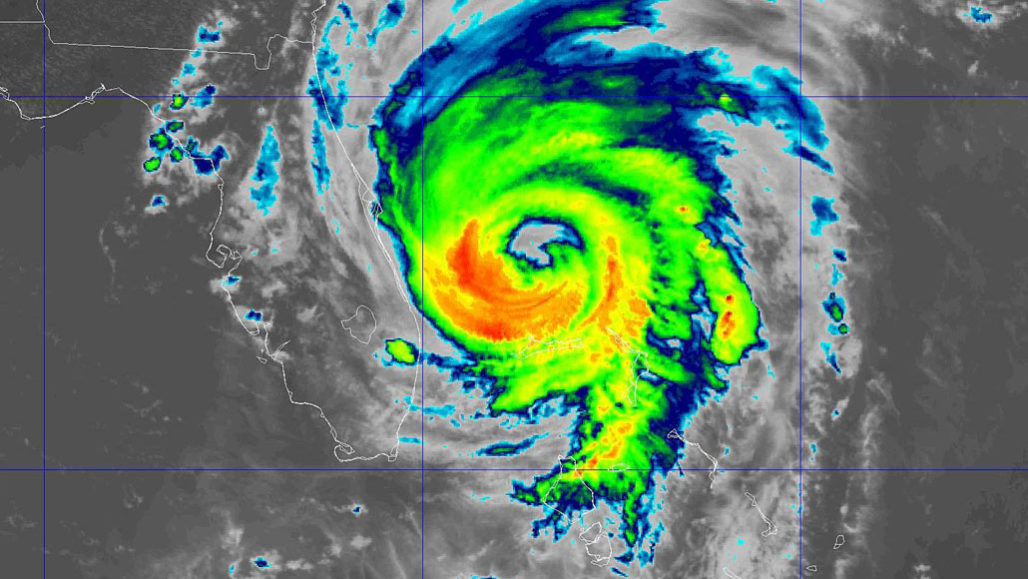

[click to embiggen]

This applies to their individual ObamaPlans only, but still: Kudos!

■ We last blogged on insuring drones back in '16:

"[Here] are insurance coverages and how they are likely to apply. Keep in mind all claims are handled on a case-by-case basis, and there may be more exclusions and conditions that apply as drone technology evolves."

But that was about personal use of this tech. Now, the folks at Worldwide Facilities has a new post up about the risks issues faced by businesses using it, and what they can expect insurance-wise:

"The Claims and Litigation Management Alliance has identified privacy, property, and bodily injury as key issues for insurers, along with growing concerns over technology risks."

Interesting stuff.

■ This is a little off the beaten path for us, but it does relate to an important Long Term Care issue. Our friends at OneAmerica bring us Thorpe's Story:

"Since being appointed power of attorney for his ailing father, Thorpe has faced increasingly difficult decisions about how to best provide care. His dad wants to stay in a house that is no longer safe for him and needs more care than Thorpe is able to provide by himself. This experience has made Thorpe consider the situation he might find himself in one day."

To be sure, POAs are an issue best handled by one's attorney, but it's a conversation all too few of us actually have. And there are important considerations here, both for ourselves and our loved ones.

■ We last blogged on insuring drones back in '16:

"[Here] are insurance coverages and how they are likely to apply. Keep in mind all claims are handled on a case-by-case basis, and there may be more exclusions and conditions that apply as drone technology evolves."

But that was about personal use of this tech. Now, the folks at Worldwide Facilities has a new post up about the risks issues faced by businesses using it, and what they can expect insurance-wise:

"The Claims and Litigation Management Alliance has identified privacy, property, and bodily injury as key issues for insurers, along with growing concerns over technology risks."

Interesting stuff.

■ This is a little off the beaten path for us, but it does relate to an important Long Term Care issue. Our friends at OneAmerica bring us Thorpe's Story:

"Since being appointed power of attorney for his ailing father, Thorpe has faced increasingly difficult decisions about how to best provide care. His dad wants to stay in a house that is no longer safe for him and needs more care than Thorpe is able to provide by himself. This experience has made Thorpe consider the situation he might find himself in one day."

To be sure, POAs are an issue best handled by one's attorney, but it's a conversation all too few of us actually have. And there are important considerations here, both for ourselves and our loved ones.