Universal Life insurance was developed in the early 80’s primarily as a response to money market accounts.

Hunh?

Okay, let’s rewind a little:

Back in the early 80’s interest rates were sky-high (20%+ mortgages, 17%+ money market “savings” accounts). Folks that owned whole life insurance policies saw a growth rate of 3-5%, and a loan interest rate of about 4-5%. A lot of these folks looked at their insurance policies, and did the math: I can borrow the funds for 5%, make 18%, and there’s essentially no risk.

Where do I sign up?!

Carriers were understandably less than sanguine about this, and looked for a way to staunch the flow. They knew that a lot of folks were intrigued by the “Buy Term and Invest the Difference” approach, and sought to capitalize on it. What emerged was a policy that stripped away many of the guarantees of whole life (WL), but offered the potential of greater growth. This was also the dawn of the modern computer age, which made it technologically possible for companies to illustrate more complex policies.

Thus was born Universal Life. It offered higher current interest rates than conventional WL plans, and a minimum guaranteed interest rate. The policy itself was really a hybrid: the cost of the insurance was, for the first time, “unbundled” from the plan, and one could see what the actual cost of the death benefit could be. And that cost could change from time to time, based on the insurance companies’ experience.

There is a current charge, and a guaranteed maximum charge.

It also offered more flexibility than its WL predecessor: one could change the premium, and the death benefit, pretty much at will. So if one came into some extra cash, one could dump it into the policy to give it a push; if one had a run of bad luck, one could lower (or even skip) the premiums.

Pretty cool, and a useful tool.

The problem is that we all assumed what has historically been the case: that over a given period of time (say, 20 years), interest rates always go up. That is, they go up and down, but the average interest rate for that 20 years will always be higher than the initial rate. By the way, I’m not pontificating here: I actually did the research early on in my career.

The problem is, for the past 10 or 15 years, this has not been the case, and the policies are beginning to “blow up.” That’s insurespeak for lose value, and threaten to lapse.

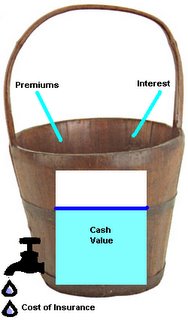

Think of the policy as a bucket:

At the top, we see Joe’s premiums going in, year after year. And we see the insurance company depositing interest each year.

In the middle, we see the cash value of the policy growing and growing (it’s comparable to the equity in your house).

At the bottom, there’s a spigot, draining out the cash value at a rate that’s determined primarily by the cost of the insurance (although loan interest would play a part, as well). In the early years, when Joe’s young, the spigot is opened just a little, so only a few drops leak out, and they’re more than compensated for by the premiums and the interest.

The goal is to keep enough “water” (cash value) in the bucket so that it doesn’t ever run dry.

Ok, so now what?

Well, for that, see Part 2…