Thursday, November 30, 2017

Thanks for holding. We know your time is valuable....

Health Net...

Application submitted via fax for an individual plan on November 14.

Check sent via Priority Mail. Received on 11/16

11/27 - After being unable to log into the broker site to check status, I called their IFP broker service number. The rep was unable to locate the application and promised to call back the next day. She didn't.

11/30 - Calling again. The phone wait time is quoted as 126 minutes. After 46 minutes, listening to the same inane music and announcements, I believe it.

This is inexcusably rude.

I don't care what excuse they have. How can any business be this disrespectful of someone's time?

Thursday LinkFest

■ Remember this: "If you like your doctor (or hospital), you can keep your doctor (or hospital)?"

Too bad, so sad. As FoIB Jeff M alerts us:

"[R]estructuring lawyers are now warning that the healthcare industry is about to experience a massive wave of hospital bankruptcies."

Of course,this isn't entirely unexpected: while insurance rates have skyrocketed, that trend hasn't translated to increased provider revenue. In fact, "[h]ealth-care bankruptcy filings have more than tripled this year."

■ Another FoIB, NDH, tips us to this helpful video explaining the Health Care Sharing Ministry model:

How Does MediShare Work?

■ And speaking of health care sharing ministries: I long ago opted to take a pass on selling them because:

"I'm an insurance agent, and I hold myself out (semi-)professionally as such. So if I sell a Medishare plan, which is specifically not insurance, I'd be concerned about an E&O claim in-the-making."

And lo-and-behold, today's email holds this warning from ARN:

"Recent solicitations from Risk Sharing Groups have caused concerns among Life Insurance Agents. Consider a few key points when evaluating an Errors & Omissions Policy"

I had had no idea such programs existed. Apparently, they're available for agents who don't want to pay for legit Errors and Omissions coverage. The plans appear to be modeled on the health care sharing ministries, and are therefore not insurance, so there's some questions about whether any claims will actually be paid.

And there's this, which seems to be a show-stopper:

"In a Risk Sharing Plan the right to reimbursement only occurs once the wrongful act(s) have been entered in court and all appeals have been settled. This could take years."

Yikes.

Too bad, so sad. As FoIB Jeff M alerts us:

"[R]estructuring lawyers are now warning that the healthcare industry is about to experience a massive wave of hospital bankruptcies."

Of course,this isn't entirely unexpected: while insurance rates have skyrocketed, that trend hasn't translated to increased provider revenue. In fact, "[h]ealth-care bankruptcy filings have more than tripled this year."

■ Another FoIB, NDH, tips us to this helpful video explaining the Health Care Sharing Ministry model:

How Does MediShare Work?

■ And speaking of health care sharing ministries: I long ago opted to take a pass on selling them because:

"I'm an insurance agent, and I hold myself out (semi-)professionally as such. So if I sell a Medishare plan, which is specifically not insurance, I'd be concerned about an E&O claim in-the-making."

And lo-and-behold, today's email holds this warning from ARN:

"Recent solicitations from Risk Sharing Groups have caused concerns among Life Insurance Agents. Consider a few key points when evaluating an Errors & Omissions Policy"

I had had no idea such programs existed. Apparently, they're available for agents who don't want to pay for legit Errors and Omissions coverage. The plans appear to be modeled on the health care sharing ministries, and are therefore not insurance, so there's some questions about whether any claims will actually be paid.

And there's this, which seems to be a show-stopper:

"In a Risk Sharing Plan the right to reimbursement only occurs once the wrongful act(s) have been entered in court and all appeals have been settled. This could take years."

Yikes.

Wednesday, November 29, 2017

Wrapping Up LTCi Awareness Month

As we near the end of LTCIAM, the good folks at Visionary Marketing offer this handy "Protection Decision Tree" to help folks determine what kind of plan might fit them best:

[click to embiggen]

Thanks, VMG!

Tuesday, November 28, 2017

ObamaCare Fail '17

Courtesy of FoIB Ʀєfùsєηíκ, the latest on this year's Open Debacle Enrollment:

"Obamacare Exchanges are on track to have 18-28% fewer members than at the end of last year's open enrollment."

Hardly surprising, of course, given the current state of premiums.

Here's another 1,000 words on the subject:

#Winning!

[Chart courtesy of Forbes]

"Obamacare Exchanges are on track to have 18-28% fewer members than at the end of last year's open enrollment."

Hardly surprising, of course, given the current state of premiums.

Here's another 1,000 words on the subject:

[click to embiggen]

#Winning!

[Chart courtesy of Forbes]

Monday, November 27, 2017

Much Vaunted National Health System© strikes again

Another day, another MVNHS© screw-up:

"A glamorous equestrian has been left in agony and vomiting her excrement after she claims minor keyhole surgery went horribly wrong"

34-year old Kelly Yeoman was initially hospitalized for a small "fluid filled sac" on her ovary. But by the time the (rocket?) surgeons were done with her, she was left confined to a hospital bed, her body "slowly filling with her own excrement."

And since it's not likely that her care's going to be getting any better under the auspices of the MVNHS©, her family and friends are trying to raise about $13,000 so she can avail herself of private treatment.

And it's urgent:

"[H]er bowel could perforate at any moment – at best meaning she would need a colostomy."

But hey, free!

"A glamorous equestrian has been left in agony and vomiting her excrement after she claims minor keyhole surgery went horribly wrong"

34-year old Kelly Yeoman was initially hospitalized for a small "fluid filled sac" on her ovary. But by the time the (rocket?) surgeons were done with her, she was left confined to a hospital bed, her body "slowly filling with her own excrement."

And since it's not likely that her care's going to be getting any better under the auspices of the MVNHS©, her family and friends are trying to raise about $13,000 so she can avail herself of private treatment.

And it's urgent:

"[H]er bowel could perforate at any moment – at best meaning she would need a colostomy."

But hey, free!

A Tale of Two Scenarios

Tuesday evening a buddy of mine sent me a text regarding insurance for his employee. Since it's only two employees in his small business they don't offer a group plan. The text exchange below is why the middle class is getting crushed with Obamacare. It's also a huge reason why using a professional insurance agent can make a big difference.

Even with the huge subsidy they will still pay $5100 for a $12,500 deductible. That's 8.5% of their income in premium and an additional 21% of their income if they meet the deductible.

The Affordable Care Act. Well, maybe not so affordable.

Even with the huge subsidy they will still pay $5100 for a $12,500 deductible. That's 8.5% of their income in premium and an additional 21% of their income if they meet the deductible.

The Affordable Care Act. Well, maybe not so affordable.

Friday, November 24, 2017

Life Happens: Parent’s Sacrifice – and Gift

Roberto Loera spent his winters working at ski resorts in Colorado, and his summers in Mexico with his family. The time came that his family's visas had been approved, and they could be together year 'round.

Unfortunately, that wasn't destined to last; fortunately, he'd listened to his insurance agent:

[Hat Tip: Illinois Mutual]

Unfortunately, that wasn't destined to last; fortunately, he'd listened to his insurance agent:

[Hat Tip: Illinois Mutual]

How to Find Low Cost and Free Prescription Drugs

Medicare beneficiaries on a fixed income often have to decide between food and their medications. Medical bills can be tough on budgets, especially when your only income is from Social Security.

We have found several reliable sources where you can get prescription drugs for a few dollars and in some cases, 100% free. Here are a few examples.

During the 2018 Medicare open enrollment period keep these tips in mind.

We reviewed drug plan options for over 400 clients this year. The annual savings ranged from $150 to over $6,000! Many of our clients will save $600 - $800 per year.

If you would like more information on how you can potentially save hundreds or thousands of dollars on your prescription drugs, follow this link to money saving ideas for finding Free and Low Cost Prescription Drugs.

#FreeLowCostPrescriptionDrugs #MedicareOpenEnrollment

We have found several reliable sources where you can get prescription drugs for a few dollars and in some cases, 100% free. Here are a few examples.

- NeedyMeds $4 Generic Drug Programs

- GoodRx Generic Discount program

- Blue Sky Drugs - reliable Canadian pharmacy

- Pharmacy Checker - searches US and Canada for low cost medications

During the 2018 Medicare open enrollment period keep these tips in mind.

- Review your drug plan every year, even if there are no drug changes

- Consider plans with a deductible

- Check out the carriers preferred pharmacy list

- Research ways to avoid the donut hole

We reviewed drug plan options for over 400 clients this year. The annual savings ranged from $150 to over $6,000! Many of our clients will save $600 - $800 per year.

If you would like more information on how you can potentially save hundreds or thousands of dollars on your prescription drugs, follow this link to money saving ideas for finding Free and Low Cost Prescription Drugs.

#FreeLowCostPrescriptionDrugs #MedicareOpenEnrollment

Wednesday, November 22, 2017

The Positive Side of Sharing

We try not to take too firm a stand on products we don't sell, and of course a healthy skepticism is always in order for non-insurance products that claim to pay for health care.

For example, we've blogged quite few times on Health Care Sharing Ministries, most recently here:

"My claim from October had still not been paid. Yesterday I received a notice ... that since I was no longer a paying member my medical claims are no longer eligible for payment!"

But we also know folks who've had positive experiences. This past Spring, for example, long-time IB reader Thomas L reported that:

"We are using a sharing ministry, Samaritan Ministries, as of September. In Oklahoma, the premium increase for this year was announced at 51% and all but BCBS were exiting the market statewide*. This is after an almost 40% increase the year before."

Yikes.

But again, it's not just about saving money upfront: how will one fare once claims start to accrue?

Well, recently Tom sent this update:

For example, we've blogged quite few times on Health Care Sharing Ministries, most recently here:

"My claim from October had still not been paid. Yesterday I received a notice ... that since I was no longer a paying member my medical claims are no longer eligible for payment!"

But we also know folks who've had positive experiences. This past Spring, for example, long-time IB reader Thomas L reported that:

"We are using a sharing ministry, Samaritan Ministries, as of September. In Oklahoma, the premium increase for this year was announced at 51% and all but BCBS were exiting the market statewide*. This is after an almost 40% increase the year before."

Yikes.

But again, it's not just about saving money upfront: how will one fare once claims start to accrue?

Well, recently Tom sent this update:

"Baby is here!

So far so good on all things Samaritan. All current expenses are already paid, the money for the obgyn is pre-paid to the clinic (which for whatever reason they hold in escrow), and the money for the hospital’s delivery estimate I have in a separate account ready to go, but since he was just delivered on 9/17, we have not had any bills yet.

I’ll have a much fuller report after the hospital really bills us, and, if it is like last time with BCBS, that weird never-ending stream of bills from the doctors and staff that come into your hospital room but technically aren’t with the hospital, so bill you separately."

Mazel tov!

Thanks, Tom, for keeping us updated, and have a GREAT Thanksgiving!

Thanks, Tom, for keeping us updated, and have a GREAT Thanksgiving!

Tuesday, November 21, 2017

New News from the Herr Gruber Department

Thanks to our good friend Rich Weinstein, we have new video from Jonathan Gruber in the run-up to last year's elections:

Pull quote: "Not only is Obamacare a great law, and successful, but it was done so “honestly”

Click here for the full story...

Pull quote: "Not only is Obamacare a great law, and successful, but it was done so “honestly”

Click here for the full story...

The $15 Per Hour Challenge

Seems like more and more workers are clamoring for a "livable wage" in the area of $15 per hour. So far this experiment has mixed, but mostly negative reviews, depending on the spin.

A Google search for "how is the $15 minimum wage working" shows some results claiming it is a success, while others pan the concept.

Left leaning HuffPo claims it is working, while Money-CNN say the experiment has its' doubts. Empire builder Jeff Bezo's WaPo cites a "very credible" study that seems to lean toward the negative side.

One very quiet experiment by a major retailer involves an autonomous nighttime janitor that cleans the floors.

Meet "Wally"

The age of automation could be coming soon to a store near you.

Beep. Beep.

#$15MinimumWage #Robots

A Google search for "how is the $15 minimum wage working" shows some results claiming it is a success, while others pan the concept.

Left leaning HuffPo claims it is working, while Money-CNN say the experiment has its' doubts. Empire builder Jeff Bezo's WaPo cites a "very credible" study that seems to lean toward the negative side.

One very quiet experiment by a major retailer involves an autonomous nighttime janitor that cleans the floors.

Meet "Wally"

Walmart has quietly begun testing an advanced, autonomous floor scrubber during overnight shifts in five stores near the company's headquarters in Bentonville, Ark., a move that could free workers from hours of drudgery, but that has already raised alarm among some employees. As the U.S.’s largest private-sector employer, Walmart is watched carefully for any shifts it makes to its workplace.

The machine resembles a traditional scrubber but comes equipped with similar technology used in self-driving cars: extensive cameras, sensors, algorithms and Lidar for navigational mapping. Think of it as a Roomba crossed with a Tesla. A human must first drive the device to train it on a path; it can then operate largely independently, including when a store is open to customers. If a person or object gets in its way, it momentarily pauses and adjusts course. LinkedIn

The age of automation could be coming soon to a store near you.

Beep. Beep.

#$15MinimumWage #Robots

Monday, November 20, 2017

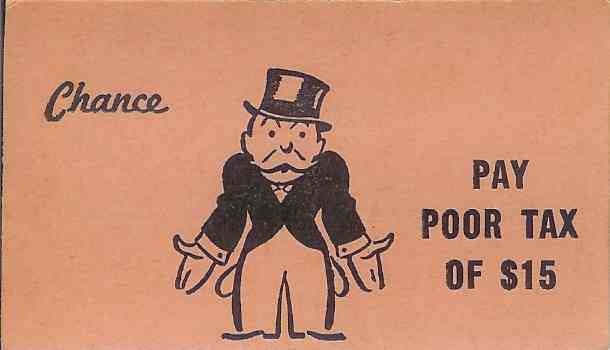

Paying the Obamacare Poor Tax

When healthcare.gov opened for business a few weeks ago many were shocked at the prices. You would think by now most folks would understand that quality health insurance like Obamacare isn't cheap.

You get what you pay for.

The substandard plans offered before 2014 were horrible. Families with premiums under $500 per month were getting cheated. Many of those plans did not cover maternity. Women were forced to open their purses to pay for their own birth control pills. People who wanted annual exams had to actually PAY for these services.

Thanks to Obamacare almost all the carriers that offered these low rent policies have been driven out of the market place. Now many of those health care services are FREE. Women who want babies no longer have to plan ahead and save money to pay for the birth.

Their Obamacare insurance plans pay the cost of maternity so they don't have to.

Junk health insurance plans have been replaced with Olympic metal plans like bronze, silver and gold that are easy to understand and compare.

Now consumers actually KNOW what they are getting for their money.

If you want quality you must expect to pay for it.

A $2 steak just isn't the same as a $30 steak. The reason why one steak has a higher price than the other is because the difference in the two is unmistakable. You don't need refined taste buds to appreciate the better things in life.

Some say $30 for a steak is outrageous.

I say they just don't appreciate quality.

If you think options are slim now and premiums are high, you haven't seen anything yet. Not everyone appreciates a fine wine and delicious juicy steak.

Let them eat cake.

#Obamacare #UnaffordablePremiums

You get what you pay for.

The substandard plans offered before 2014 were horrible. Families with premiums under $500 per month were getting cheated. Many of those plans did not cover maternity. Women were forced to open their purses to pay for their own birth control pills. People who wanted annual exams had to actually PAY for these services.

Thanks to Obamacare almost all the carriers that offered these low rent policies have been driven out of the market place. Now many of those health care services are FREE. Women who want babies no longer have to plan ahead and save money to pay for the birth.

Their Obamacare insurance plans pay the cost of maternity so they don't have to.

Junk health insurance plans have been replaced with Olympic metal plans like bronze, silver and gold that are easy to understand and compare.

Now consumers actually KNOW what they are getting for their money.

Consumers here at first did not believe the health insurance premiums they saw when they went shopping for coverage this month on HealthCare.gov. Only five plans were available, and for a family of four with parents in their mid-30s, the cheapest plan went typically for more than $2,400 a month, nearly $30,000 a year. - NY Times

If you want quality you must expect to pay for it.

A $2 steak just isn't the same as a $30 steak. The reason why one steak has a higher price than the other is because the difference in the two is unmistakable. You don't need refined taste buds to appreciate the better things in life.

The situation here in Charlottesville is an extreme example of a pattern that can be seen in other places around the country. The Affordable Care Act is working fairly well for people who receive subsidies in the form of tax credits, said Doug Gray, the executive director of the Virginia Association of Health Plans, which represents insurers. But for many others, especially many middle-class families, he said, “the premium is outrageous, and it’s unaffordable.”

Some say $30 for a steak is outrageous.

I say they just don't appreciate quality.

If you think options are slim now and premiums are high, you haven't seen anything yet. Not everyone appreciates a fine wine and delicious juicy steak.

Let them eat cake.

#Obamacare #UnaffordablePremiums

Puzzling CHIP

Okay folks, what's missing from this?

Hint: CHIP ain't free (and it's not "insurance").

Answer: 8.5 million kids covered ... at what cost?

These are children of families that "don't qualify for Medicaid, yet can't afford private insurance," which would would seem to be describing the "middle class," but apparently not.

And despite its name, CHIP is NOT insurance: there are no premiums, no skin in the game.

And here's a question: since we're required by law to buy health insurance that includes first dollar preventive care benefits, why aren't these kids on ObamaPlans? Surely it can't be for economic reasons: these plans are, after all affordable and effective.

'Tis a puzzler.

[Hat Tip: FoIB Bill M]

[click to embiggen]

Hint: CHIP ain't free (and it's not "insurance").

Answer: 8.5 million kids covered ... at what cost?

These are children of families that "don't qualify for Medicaid, yet can't afford private insurance," which would would seem to be describing the "middle class," but apparently not.

And despite its name, CHIP is NOT insurance: there are no premiums, no skin in the game.

And here's a question: since we're required by law to buy health insurance that includes first dollar preventive care benefits, why aren't these kids on ObamaPlans? Surely it can't be for economic reasons: these plans are, after all affordable and effective.

'Tis a puzzler.

[Hat Tip: FoIB Bill M]

Friday, November 17, 2017

Some Thoughts on ObamaComp

Although I'm no longer actively working in this market, I do get the various carrier updates and contractual changes. Yesterday's mail brought this from Evolent (to which I'm connected via what used to be Premier Health Insurance):

"On behalf of Premier Health Plan, Evolent Health would like to thank you for your relationship ... it is necessary to amend [your contract]."

Regular readers already know where this is heading, but I think this may be instructive as to why I received a particular phone call yesterday:

"On behalf of Premier Health Plan, Evolent Health would like to thank you for your relationship ... it is necessary to amend [your contract]."

Regular readers already know where this is heading, but I think this may be instructive as to why I received a particular phone call yesterday:

[click to embiggen]

I would estimate that it takes at least a good hour (likely more, plus service time after the sale) to do a decent job for a client, even when there are so few choices still left. And of course, there's overhead and the like, so that $5 is quickly eaten up.

And once again I would ask: will their rates be lowered to reflect the decreased comp?

(Spoiler Alert: Not likely)

Oh, about that phone call?

Well, I was the third or fourth agent she'd contacted about health insurance for her son and daughter-in-law. They're currently with CareSource (which is primarily a Medicaid carrier, but has branched out into the "commercial" arena, as well). The county in which they live currently has these health insurance choices: CareSource. Since they don't use agents, there's no incentive for anyone to sell them. Which is why the poor lady was so frustrated.

And who can blame her?

Oh, did I mention the almost 100% ratedecrease increase?

Insult and injury, ObamaCare is thy name.

And once again I would ask: will their rates be lowered to reflect the decreased comp?

(Spoiler Alert: Not likely)

Oh, about that phone call?

Well, I was the third or fourth agent she'd contacted about health insurance for her son and daughter-in-law. They're currently with CareSource (which is primarily a Medicaid carrier, but has branched out into the "commercial" arena, as well). The county in which they live currently has these health insurance choices: CareSource. Since they don't use agents, there's no incentive for anyone to sell them. Which is why the poor lady was so frustrated.

And who can blame her?

Oh, did I mention the almost 100% rate

Insult and injury, ObamaCare is thy name.

Thursday, November 16, 2017

This Picture: What's Wrong With It?

NAILBA - the National Association of Independent Life Brokerage Agencies - is currently in the midst of its 36th annual convention, and by all accounts a fine time is being had by all. Which is, of course, great, but also provides an excellent illustration of the disconnect between trade groups such as this (and of course, they're far from unique in this regard) and how the public perceives those of us in the field.

Several years ago, I noted the irony inherent in a continuing education course on ethics:

"My fellow participants couldn't understand why I was giggling about an "Ethics" course given - for free! - to agents who'd received a "goody bag" full of tschochkes (chip clips, staplers, etc)."

Well, apparently the folks sponsoring that class were pikers:

ExamOne is a vendor agents and carriers use for medical exams for insurance applicants.

So much for those Ethics CE requirements....

Several years ago, I noted the irony inherent in a continuing education course on ethics:

"My fellow participants couldn't understand why I was giggling about an "Ethics" course given - for free! - to agents who'd received a "goody bag" full of tschochkes (chip clips, staplers, etc)."

Well, apparently the folks sponsoring that class were pikers:

#ExamOne hosting Margarita Mixer at #NAILBA36 #GlobalBankers @ The Diplomat Beach Resort https://t.co/dOtQRui0VB— Ken Leibow (@kaptk) November 15, 2017

ExamOne is a vendor agents and carriers use for medical exams for insurance applicants.

So much for those Ethics CE requirements....

Wednesday, November 15, 2017

Another Government-run Health Care Success Story

Words fail:

"A veteran committed suicide by setting himself on fire in front of a New Jersey VA clinic after staff at the clinic repeatedly failed to ensure he received adequate mental health care"

Charles Ingram, a 51 year old Gulf War vet, was actually cleared for treatment at a non-VA facility, but the bureauweenies in charge failed to follow through.

But sure, let's go all-in on state-run health "care."

[Hat Tip: FoIB NARNfan]

"A veteran committed suicide by setting himself on fire in front of a New Jersey VA clinic after staff at the clinic repeatedly failed to ensure he received adequate mental health care"

Charles Ingram, a 51 year old Gulf War vet, was actually cleared for treatment at a non-VA facility, but the bureauweenies in charge failed to follow through.

But sure, let's go all-in on state-run health "care."

[Hat Tip: FoIB NARNfan]

Tuesday, November 14, 2017

Sad news

We've just learned of the passing of Dr Uwe Reinhardt earlier today. His was a voice of reason and thoughtfulness, and he had a unique talent for making complex health care policy understandable.

We first noted the great work of Dr Reinhardt in this post by co-blogger Bob back in 2009:

"The insurance industry is congenitally weak in bargaining with supply side of the American health sector,” explained Princeton University health economist Uwe Reinhardt on a recent NPR Money Planet segment. Reinhardt believes that insurers largely dance to the fiscal tune whistled by hospitals and physicians."

A little over a year later, co-blogger Mike quoted another great example of Dr Reinhardt's insight:

"Thus, after blushing over miserly fee updates, taxpayers might go on to ask physicians why an average annual compound increase of 5.4 percent in spending per Medicare beneficiary was not enough to give the nation’s elderly good medical care."

Ouch.

He will be missed.

We first noted the great work of Dr Reinhardt in this post by co-blogger Bob back in 2009:

"The insurance industry is congenitally weak in bargaining with supply side of the American health sector,” explained Princeton University health economist Uwe Reinhardt on a recent NPR Money Planet segment. Reinhardt believes that insurers largely dance to the fiscal tune whistled by hospitals and physicians."

A little over a year later, co-blogger Mike quoted another great example of Dr Reinhardt's insight:

"Thus, after blushing over miserly fee updates, taxpayers might go on to ask physicians why an average annual compound increase of 5.4 percent in spending per Medicare beneficiary was not enough to give the nation’s elderly good medical care."

Ouch.

He will be missed.

Monday, November 13, 2017

From the P&C Files: Foreign General Liability

Regular readers know our friends at Global Underwriters for their wide array of travel medical options, but they also work the other side of the insurance fence: since a lot of their business comes from employers with substantial international exposure, GU has an interesting product called Foreign General Liability (FGL) coverage. I'll let GU's Peter Schulteis explain:

"Today, thriving companies aren't just operating globally. They're sourcing, producing, recruiting, and genuinely "thinking" in global terms. However, most domestic General liability policies only cover lawsuits brought within US borders. This leaves US companies, schools, churches, non-profits, etc. and their international operations without a legal or financial safety net if taken to court abroad."

Okay, so what is Foreign General Liability coverage?

"FGL primarily consists of 3 main benefits:

■ International Commercial General Liability: The first line of defense against costly legal actions arising from events occurring outside US borders.

Typical Coverages: Bodily Injury and Property Damage, Employee Benefits Liability, Personal and Advertising Injury Liability, and Medical Payments.

■ Employer's Responsibility/Worker's Compensation: Outside the US, nothing quite compares to our nation's own worker's compensation system for comprehensive coverage [ed: as we've seen before].

Typical Coverages: Foreign Voluntary Worker's Compensation (Statutory worker's comp benefits for US and Non-US employee's), Employer's Liability - Bodily injury coverage to employee's for accident or endemic illness contracted outside the US.

■ Foreign Auto Liability: Each country and jurisdiction around the world has its own rules and regulations concerning automobile liability - from who would be at fault if an accident were to occur to how an automobile liability claim should be handled.

Typical Coverages: Applies to any auto of the insured, including owned, hired, and non-owned vehicles, Auto Bodily Injury/Property Damage Liability."

Nice. What are typical coverage amounts?

"FGL limits are typically $1 - $2 Million, with the possibility of increasing benefit limits to $5 Million, if desired."

Thanks, Peter!

If you (or someone you know) would like additional details (or even a quote), be sure to stop by Global Underwriters' site.

"Today, thriving companies aren't just operating globally. They're sourcing, producing, recruiting, and genuinely "thinking" in global terms. However, most domestic General liability policies only cover lawsuits brought within US borders. This leaves US companies, schools, churches, non-profits, etc. and their international operations without a legal or financial safety net if taken to court abroad."

Okay, so what is Foreign General Liability coverage?

"FGL primarily consists of 3 main benefits:

■ International Commercial General Liability: The first line of defense against costly legal actions arising from events occurring outside US borders.

Typical Coverages: Bodily Injury and Property Damage, Employee Benefits Liability, Personal and Advertising Injury Liability, and Medical Payments.

■ Employer's Responsibility/Worker's Compensation: Outside the US, nothing quite compares to our nation's own worker's compensation system for comprehensive coverage [ed: as we've seen before].

Typical Coverages: Foreign Voluntary Worker's Compensation (Statutory worker's comp benefits for US and Non-US employee's), Employer's Liability - Bodily injury coverage to employee's for accident or endemic illness contracted outside the US.

■ Foreign Auto Liability: Each country and jurisdiction around the world has its own rules and regulations concerning automobile liability - from who would be at fault if an accident were to occur to how an automobile liability claim should be handled.

Typical Coverages: Applies to any auto of the insured, including owned, hired, and non-owned vehicles, Auto Bodily Injury/Property Damage Liability."

Nice. What are typical coverage amounts?

"FGL limits are typically $1 - $2 Million, with the possibility of increasing benefit limits to $5 Million, if desired."

Thanks, Peter!

If you (or someone you know) would like additional details (or even a quote), be sure to stop by Global Underwriters' site.

Friday, November 10, 2017

It's a Holly Jolly Friday LinkFest

(All links courtesy FoIB Holly R)

■ Britain's Much Vaunted National Health System© continues to prove that gummint-run health "care" #Fails at reining in costs:

"[T]hree highly influential health think-tanks - the King's Fund, the Nuffield Trust and the Health Foundation - published a joint report calling for an extra £4bn to be given to health next year."

Heh.

■ "Every Hour, Prostate Cancer Kills 45 Men. This Foundation Has Raised $769 Million to Fight it"

And yet, unlike mammograms, prostate exams aren't considered Essential Health Benefits (so they aren't first dollar).

Men's Health Matters (but not to ACA proponents).

■ And now for some good news:

"In world first, Israeli hospital employs MRI designed for infants"

MRI's have become almost as ubiquitous as X-Ray machines and EKG's, but one of the challenges is that patients need to stay very still while being scanned, which is a problem when dealing with infants. The generally accepted solution seems to have been anesthesia, but that poses its own set of risks in ones so small and vulnerable. This device seems to have solved the problem.

Yasher koach (that's Hebrew for "Kudos")!

■ Britain's Much Vaunted National Health System© continues to prove that gummint-run health "care" #Fails at reining in costs:

"[T]hree highly influential health think-tanks - the King's Fund, the Nuffield Trust and the Health Foundation - published a joint report calling for an extra £4bn to be given to health next year."

Heh.

■ "Every Hour, Prostate Cancer Kills 45 Men. This Foundation Has Raised $769 Million to Fight it"

And yet, unlike mammograms, prostate exams aren't considered Essential Health Benefits (so they aren't first dollar).

Men's Health Matters (but not to ACA proponents).

■ And now for some good news:

"In world first, Israeli hospital employs MRI designed for infants"

MRI's have become almost as ubiquitous as X-Ray machines and EKG's, but one of the challenges is that patients need to stay very still while being scanned, which is a problem when dealing with infants. The generally accepted solution seems to have been anesthesia, but that poses its own set of risks in ones so small and vulnerable. This device seems to have solved the problem.

Yasher koach (that's Hebrew for "Kudos")!

Thursday, November 09, 2017

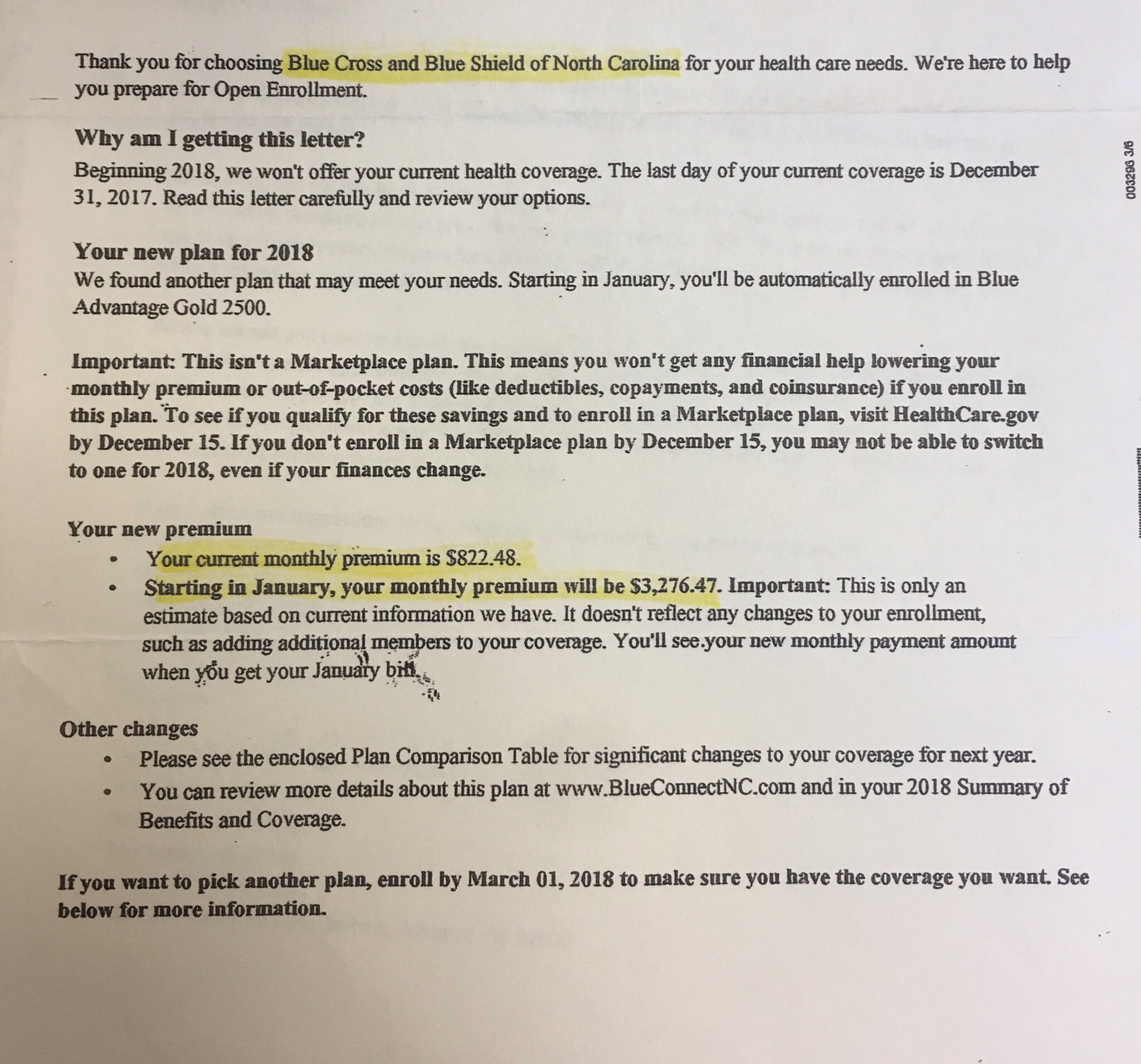

The ACA is Working - and Better than Expected!

Given that the explicit goal has always been single-payer:

[click to embiggen]

"Your current monthly premium is $822.48. Starting in January, your monthly premium will be $3,276.47"

Hunh. Funny way to spell 3000% decrease.

Weird.

[Hat Tip: FoIB Holly R]

Hunh. Funny way to spell 3000% decrease.

Weird.

[Hat Tip: FoIB Holly R]

Health Wonk Review - Notable Quotables edition

Our good friend (and favorite health care economist) Jason Shafrin hosts this week's fun, uniquely designed roundup of health care fun and policy.

Wednesday, November 08, 2017

LifeAid: An Accelerated Benefits story

Back in the 80's and early 90's, when the AIDS "epidemic" was just taking off, a lot of folks - especially singles and the elderly - began looking for ways to leverage their life insurance policies. For those with no dependents, keeping a policy in force made little sense, and by selling their plans they could raise quick cash to pay for alternative treatments, or even just take a cruise.

Unfortunately, this lead to a lot of questionable practices, and even more questionable tax implications. And so, as part of HIPAA, a new word entered the popular lexicon: viatical. Basically, one can sell one's plan to a 3rd party with little (or no) tax consequence.

Naturally, insurance companies weren't too keen on any of this, but the cat was already out of the metaphorical bag. Eventually, the industry settled on the old "if you can't beat 'em, join 'em" strategy, and thus was born the Accelerated Benefit Rider. These enable the policyholder to "access" the face amount as a living benefit. Naturally, there are some caveats and potential tax implications, but it's a reasonably effective answer to the viatical issue.

Illinois Mutual has provided a helpful primer on how they work:

Thanks, IM!

Unfortunately, this lead to a lot of questionable practices, and even more questionable tax implications. And so, as part of HIPAA, a new word entered the popular lexicon: viatical. Basically, one can sell one's plan to a 3rd party with little (or no) tax consequence.

Naturally, insurance companies weren't too keen on any of this, but the cat was already out of the metaphorical bag. Eventually, the industry settled on the old "if you can't beat 'em, join 'em" strategy, and thus was born the Accelerated Benefit Rider. These enable the policyholder to "access" the face amount as a living benefit. Naturally, there are some caveats and potential tax implications, but it's a reasonably effective answer to the viatical issue.

Illinois Mutual has provided a helpful primer on how they work:

Thanks, IM!

Another few words on Open Enrollment

Building on yesterday morning's post, it bears repeating that even though I'm no longer active in the individual market, I still get calls, emails and referrals seeking my assistance. Since I'm loathe to just leave folks hanging, here's a brief recap of what we usually discuss:

First, going bare is not necessarily an irrational decision. When one is facing thousands (often tens of thousands) of dollars in out-of-pocket before a plan kicks in, well, it's difficult not to at least consider this route.

Second, of course, is an ObamaPlan (although these have become increasingly difficult to find, since so many areas have only one or two available). These satisfy the ObamaTax, and cover pre-existing conditions.

Third would be Short Term Medical plans, which don't satisfy the mandate, but offer lower premiums and out-of-pockets.

Fourth would be Health Care Sharing Ministries, which are ACA-compliant, but pose their own challenges.

And finally, there's what I call "Dave's Plan," which is not ACA-compliant, but can offer a valuable bridge at a reasonable price.

And yes, I know: DPC is also an option,but I'm not going there until there's a cat plan available to wrap it.

Did I miss any?

First, going bare is not necessarily an irrational decision. When one is facing thousands (often tens of thousands) of dollars in out-of-pocket before a plan kicks in, well, it's difficult not to at least consider this route.

Second, of course, is an ObamaPlan (although these have become increasingly difficult to find, since so many areas have only one or two available). These satisfy the ObamaTax, and cover pre-existing conditions.

Third would be Short Term Medical plans, which don't satisfy the mandate, but offer lower premiums and out-of-pockets.

Fourth would be Health Care Sharing Ministries, which are ACA-compliant, but pose their own challenges.

And finally, there's what I call "Dave's Plan," which is not ACA-compliant, but can offer a valuable bridge at a reasonable price.

And yes, I know: DPC is also an option,but I'm not going there until there's a cat plan available to wrap it.

Did I miss any?

Tuesday, November 07, 2017

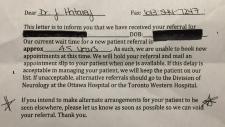

Oy Canada: CanuckCare© Strikes Again

Previously on CanuckCare© Today:

"[A] doctor can not only deny life-saving treatment for a person in their right mind who wants it, but actually have that patient, against the patient’s will and with their full mental faculties, outright executed by lethal injection."

And that's if the patient is "fortunate" enough to even get an appointment.

For many, that's quite the luxury:

"I actually thought I misread it’: Doctor ‘stunned’ over years-long wait for specialist appointment"

What the heck's she talking about?

Oh:

The joys of government-run health "care."

But hey: it's free!

[Hat Tip: FoIB Dr Gerard G]

"[A] doctor can not only deny life-saving treatment for a person in their right mind who wants it, but actually have that patient, against the patient’s will and with their full mental faculties, outright executed by lethal injection."

And that's if the patient is "fortunate" enough to even get an appointment.

For many, that's quite the luxury:

"I actually thought I misread it’: Doctor ‘stunned’ over years-long wait for specialist appointment"

What the heck's she talking about?

Oh:

The joys of government-run health "care."

But hey: it's free!

[Hat Tip: FoIB Dr Gerard G]

Back in the (MMO) Saddle Again

As regular readers know, I've basically called a moratorium on new individual health insurance sales. At least part of that is driven by the fact that my immediate service area offers exactly 3 carrier options, none of which I'm interested in representing (let alone selling).

But just a few miles north of here, Medical Mutual of Ohio still maintains a footprint, and I received a call from a young lady who was interested in climbing aboard the MMO bandwagon.

She's currently with Anthem, which is going away at the end of December (so much for that explicit promise). Fortunately for her, MMO offers a plan that fits her needs and budget, and is available off-Exchange (she's not subsidy-eligible, so no reason to venture into that dark cavern). I popped over the the MMO agent portal, ran the quote, and about 15 minutes later had her all signed up.

So why did I agree to write this case?

Well, for one, thing, it killed me to leave this poor lady hanging: she knew enough to avoid the online marketing sharks, and had educated herself on what she really needed. In short, exactly the kind of client I prefer.

So, sometimes the exception makes the rule.

But just a few miles north of here, Medical Mutual of Ohio still maintains a footprint, and I received a call from a young lady who was interested in climbing aboard the MMO bandwagon.

She's currently with Anthem, which is going away at the end of December (so much for that explicit promise). Fortunately for her, MMO offers a plan that fits her needs and budget, and is available off-Exchange (she's not subsidy-eligible, so no reason to venture into that dark cavern). I popped over the the MMO agent portal, ran the quote, and about 15 minutes later had her all signed up.

So why did I agree to write this case?

Well, for one, thing, it killed me to leave this poor lady hanging: she knew enough to avoid the online marketing sharks, and had educated herself on what she really needed. In short, exactly the kind of client I prefer.

So, sometimes the exception makes the rule.

Monday, November 06, 2017

Workers' Comp and The Mandalay

In the comments section at the link to the most recent Health Wonk Review, IB regular BernieFlatters wrote:

I found this to be particularly intriguing, so I reached out to FoIB (and Workers' Comp guru) Julie Ferguson for her thoughts, which she graciously agreed to share with us:

That’s pretty interesting, but there are no easy answers there.

Workers comp is for injuries that occur in the course & scope of the job. Every state has a slightly different law, but that is fairly common wording. In a case like this, there is a lot of gray.

They call that issue compensability. Was the injury compensable? With any claim, that is the first thing the insurer does is determine compensability. Did the injury happen at work? Probably 90% or more of the cases, that is clear cut, but there are cases like the ones you describe that end up in court.

The cops who were working, if injured, that is a clear case of workers comp.

The off-duty cops who spring into action? Not so clear. Most laws are clear that it is “in the course and scope of work” and many edge cases wind up in court. “Never off duty” is not a very precise phrase when it comes to legalities. It would be nice to think that an employer would just say “gee, that guy did the right thing, let’s cover him” but you have to be consistent and precise about compensability legalities or you can find yourself in quicksand. Your insurer, lawyer, taxpayers or board of directors are not likely to accept sentiment as valid legal basis.

Some of these issues came up in a big way in 9/11. For example, generally people are not covered by workers comp when they are “going to and fro” – traveling to or from work. You’re on your own health insurance plan if you get hit by a car or fall down. But if you are going to & fro and you fall in the employer’s parking lot, you would be covered. On 9/11, so many people were killed on their way to work or on their way fleeing from work that it got to be a big issue. Were they on the property or weren’t they? Were they working on weren’t they? It was pretty hard to sort out.

Thanks so much, Julie!

Friday, November 03, 2017

DisHartening News

(BTW: That's not a typo - wait for it...)

So FoIB The Political Hat reports that:

"More Millennials Are Turning to Witchcraft for Activism & Self-Care"

I replied that since the alternative was ObamaCare, perhaps that wasn't the poorest choice available.

To which our other good friend, Allison Bell, responded:

"But, really: What do we know about medical witchcraft economics? Maybe there's a lot of inflation in the care to goat ratio."

Which is a fair point, and one that has actually been previously addressed (now):

So FoIB The Political Hat reports that:

"More Millennials Are Turning to Witchcraft for Activism & Self-Care"

I replied that since the alternative was ObamaCare, perhaps that wasn't the poorest choice available.

To which our other good friend, Allison Bell, responded:

"But, really: What do we know about medical witchcraft economics? Maybe there's a lot of inflation in the care to goat ratio."

Which is a fair point, and one that has actually been previously addressed (now):

Shopping Medicare: The Movie

Co-blogger Bob V is trying something new, and we're pleased as punch to introduce his first video on shopping for Medicare supplements. Pretty timely, too, seeing as how it's Open Enrollment season.

Enjoy!

Enjoy!

Thursday, November 02, 2017

More Life Insurance Horribles

That's not how this works:

"Natalie Finn’s parents took out two life insurance policies on their adopted daughter before the 16-year-old died from starvation and abuse in the family's West Des Moines home"

Thefiends "parents" had allegedly purchased a $10,000 Hartford Life policy, as well as one from Modern Woodsman for $25,000.

So this poor girl was starved to death for (a measly) $35,000.

Words fail.

[Hat Tip: FoIB Joe K]

"Natalie Finn’s parents took out two life insurance policies on their adopted daughter before the 16-year-old died from starvation and abuse in the family's West Des Moines home"

The

So this poor girl was starved to death for (a measly) $35,000.

Words fail.

[Hat Tip: FoIB Joe K]

Subscribe to:

Comments (Atom)