In Part 1, we saw the consequences of a business failing to plan for the demise of one of its owners. In Part 2, we’ll discuss why properly funded Buy-Sell Agreements (BSA’s) can be valuable tools to ensure the continuation of a business in similar circumstances.

The problem arises because the needs and goals of the heirs (typically family) of the deceased owner aren’t necessarily (or even usually) shared by the surviving owner or owners. The heirs want the maximum amount of dollars for their shares in the business, a prompt estate settlement, and an end to their anxiety about potential creditors. And, they’d like to settle the issue of the business’ value for estate taxes.

On the other hand, the surviving owners would like to minimize their costs for transfer of ownership, while moving that transfer along as quickly as possible. Usually, they also put a premium on regaining full control of the business, free of (often meddlesome) family who have no experience in it.

The challenge is that, absent some formal, written contract that spells out and addresses each of these concerns, neither party gets their wishes, and the business often dies, too.

The first part of the solution is a written agreement which provides for an orderly transfer of the business at a mutually predetermined price, a method of valuing the business that will satisfy the IRS, and stability for the business, its staff and its creditors. Obviously, it’s far more effective for this to be in place beforehand.

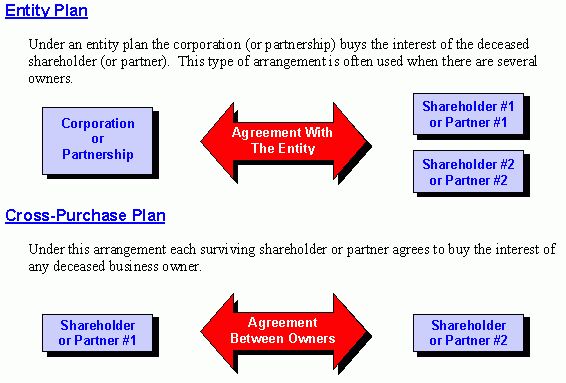

There are two basic “flavors” of BSA: Entity Plans and Cross-Purchase Plans. Each business must determine which of these is most appropriate for itself (click on graphic to enlarge):

Once an agreement has been produced (with the help of the attorney and the accountant), it’s necessary to fund it. Why? Well, here’s the thing: all the best intentions aside, just because there is a mechanism (the BSA) in place to facilitate an orderly transition, if there’s no way for the surviving owners (or the business itself) to pay the transition costs, then the whole exercise was a waste of time.

Once an agreement has been produced (with the help of the attorney and the accountant), it’s necessary to fund it. Why? Well, here’s the thing: all the best intentions aside, just because there is a mechanism (the BSA) in place to facilitate an orderly transition, if there’s no way for the surviving owners (or the business itself) to pay the transition costs, then the whole exercise was a waste of time.There are several ways to fund a BSA. The ideal solution would be relatively inexpensive, easy to administer, and wouldn’t interfere with the day-to-day operations of the business. In general, there are four funding alternatives:

• Cash

• Loan(s)

• Installment

• Insurance

Let’s tackle these one at a time.

The problem with paying cash for the deceased's interests is that there’s no way to know when it’s going to be needed: what if an owner dies tomorrow? Such funds must be put aside after taxes, and thus become somewhat expensive. There’s an opportunity cost: money put aside to fund this potential future liability are unavailable for other business uses, such as expansion or capital improvements.

If a principal dies, how easy would it be for a company to access additional credit? Even if sufficient funds can be borrowed, the additional debt is another burden facing a wounded company.

“Installment” means paying the deceased owner’s heirs over time – maybe a long time. That may well be distasteful to the heirs, and it (like loans) can be a drag on the company’s ability to move forward.

Insurance, on the other hand, satisfies all three criteria: it is (generally) inexpensive, fairly easy to administer (just remember to pay the premiums on time), and provides an immediate infusion of cash to settle debts and allow the company to have a chance at recovery.

These two “legs” – a written agreement and the funding to enable it – may well have resulted in a different, better holiday season for our jewelers.

For more on Buy-Sell Agreements and related issues, I recommend Allison Consulting's estate and business law blog.